Choosing the Right HCP Targeting & Commercial Intelligence Tool in 2026

Introduction: In today’s medtech landscape, commercial teams are under pressure to do more with less. The year 2026 finds mid-sized and scaling medical device companies navigating a complex sales environment defined by data-driven strategies and precision targeting. Nearly 9 in 10 healthcare leaders believe success in the next five years will hinge on embracing technology, data, and AI . This means that choosing the right HCP targeting tool – a platform that provides healthcare provider data and insights – has become mission-critical. A robust medtech commercial intelligence solution can help identify the right physicians and facilities, streamline sales planning, and drive a smarter medical device sales strategy. But with many options on the market, how do you pick a tool that truly fits your needs?

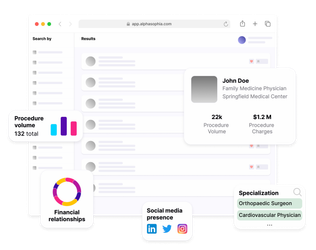

This guide takes a vendor-agnostic look at the decision. We’ll examine real-world challenges medtech commercial teams face and the core factors to consider: data accuracy, coverage and refresh rates; seamless integrations; user-friendly usability; pricing models and ROI; AI-driven prioritization; and support for specific specialties like orthopedics, gastroenterology (GI), spine, and cardiology. We’ll also explore common use cases – from territory design and launch planning to referral tracking and procedure-based sales planning – to illustrate what a great platform can do. By the end, you’ll have a clear roadmap to evaluate HCP targeting and commercial intelligence tools in 2026.

The New Reality of HCP Targeting in MedTech

Modern medtech sales teams can no longer rely on intuition or blanket approaches. Misdirected outreach wastes time and money , while competitors who harness rich data can quickly seize market opportunities. Data-driven targeting isn’t just a buzzword – it delivers tangible results. In fact, organizations that use data to guide their targeting are 23× more likely to acquire new customers and 19× more likely to be profitable . These gains matter immensely for small and mid-sized device companies trying to scale up.

At the same time, healthcare providers (HCPs) have higher expectations for personalized, relevant engagement. Generic pitches fall flat. Effective HCP targeting means focusing your limited sales and marketing resources on the physicians, surgeons, and clinics most likely to need your product – and engaging them with the right message at the right time . This requires pulling insights from a web of healthcare data: hospital procedure volumes, physician referral networks, prescribing or procedure patterns, insurance claims, demographic trends, and more. The term “healthcare commercial intelligence (HCI)” is often used to describe platforms that untangle this web of data – mapping out delivery systems, physicians, payors, patients and more – to pinpoint the best-fit opportunities for your device . In short, an HCP targeting tool is your data-driven compass for where to focus commercial efforts.

However, not all tools are created equal. Medtech teams in 2026 face an overwhelming array of software promising insights and leads. To cut through the noise, it helps to break the evaluation down into key decision points. Below, we explore those core considerations one by one, grounded in the everyday challenges commercial teams encounter.

Data Accuracy and Comprehensive Coverage

“Garbage in, garbage out” holds especially true for HCP targeting platforms. The value of any intelligence tool hinges on the quality and breadth of its data on healthcare professionals and institutions. You need confidence that the platform’s database actually reflects the real world – your market of physicians, surgeons, clinics, ambulatory surgery centers (ASCs), and hospitals. This means examining both accuracy and coverage: Is the information on each HCP correct and up-to-date? And does the dataset include enough of the relevant HCP universe in your specialty and regions?

It’s wise to ask vendors how they source and verify their data. For instance, HCP records are often keyed to National Provider Identifier (NPI) numbers in the U.S., and suppliers compete on both “percent of universe covered” and the depth of details available for each provider . Leading data providers pull from multiple sources – official registries, medical boards, hospital affiliations, claims data, physician surveys, etc. – to build a 360° profile. Crucially, they should also have rigorous verification processes. Doctors move practices, gain new certifications, or even change specialties, and such changes “are not automatically reflected in the NPI database.” A good platform will have procedures (like proactive outreach or multi-source cross-checks) to catch these updates and keep records accurate . Frequency of verification is key; ideally data is refreshed on a rolling basis (some industry experts even advocate daily updates ). If data is stale – for example, listing a physician at the wrong practice or missing that they’ve shifted focus – your team could waste valuable time or face embarrassing interactions.

Equally important is coverage of the specialties and settings you care about. Medtech companies often operate in niche segments – maybe you sell orthopedic implants, endoscopy tools for GI procedures, or spinal surgery devices. The right HCP targeting tool should have robust data in those domains. Does it list all the orthopedic surgeons in your territory, including their hospital and ASC affiliations? Does it capture gastroenterologists performing high volumes of endoscopies, or cardiologists doing structural heart procedures? In 2026, it’s not just about hospitals – the rise of outpatient and ASC migration means your data needs to extend to those sites of care. For example, orthopedics, spine, and GI are expected to see substantial growth in ASCs as more surgeries shift out of hospitals . Even cardiology, traditionally hospital-based, is rapidly moving outpatient – in fact, cardiology is now the fastest-growing ASC specialty in terms of procedure volume . A strong platform will track HCP activity across both inpatient and outpatient settings, so you don’t miss surgeons moving their cases to an ASC down the street. In short, demand comprehensive and relevant coverage: the tool should be deeply informed about your target field (procedures, physician types, facilities) rather than just offering a shallow “phone book” of providers.

Refresh Rate and Real-Time Insights

In a fast-paced commercial environment, data recency can make the difference between capitalizing on an opportunity or chasing a cold lead. Thus, look closely at how often a platform updates its information. Healthcare data is dynamic – physicians retire or relocate, new practices open, procedure volumes rise or fall, and competitive situations evolve. If the tool’s data is only updated once a year, you risk planning based on yesterday’s reality.

Many medtech-focused intelligence tools now boast continuous or frequent data refreshes. For example, good HCP data suppliers often integrate new information on a daily or weekly basis to ensure changes are reflected promptly . Find out if the platform provides alerts or news when significant changes happen (e.g. a high-value surgeon in your territory moves to a new hospital). Also inquire about the timeliness of procedure and claims data – some solutions incorporate near-real-time medical claims feeds or monthly refreshed surgery volume data, which can be invaluable for detecting trends.

The refresh rate ties into data accuracy (discussed above), but it’s worth singling out because medtech teams increasingly need real-time intelligence. Imagine planning a product launch and missing that a competitor just signed an exclusive deal at a major hospital, or failing to notice that referral patterns shifted in the last quarter. Up-to-date data can reveal emerging opportunities (like a sudden spike in a certain procedure in outpatient clinics) and risks (like a key account decreasing utilization). In 2026, many tools leverage automation and APIs to update datasets continuously, moving away from static spreadsheets. When evaluating vendors, ask: How “live” is the data? and Can the system integrate streaming data sources (e.g. new claims, formulary changes, etc.)? The more current the insights, the more agile your commercial strategy can be.

Integration with CRM and Workflows

A commercial intelligence tool delivers the most value when it fits seamlessly into your team’s existing workflows. Sales reps and marketers should be able to leverage the insights within the systems they already use (like CRM, marketing automation, or business intelligence dashboards) without constant manual exporting or toggling between platforms. In fact, lack of integration is a common pitfall – a recent industry analysis found that 80% of pharma and medtech companies use multiple CRM/marketing systems that do not integrate properly . This leads to siloed data and inconsistent messaging, undercutting the very purpose of having a targeting solution.

Therefore, prioritize tools that play nicely with others. Key integration points to consider include:

-

CRM Integration: Can the HCP targeting platform sync with your CRM (e.g. Salesforce, Microsoft Dynamics) to enrich contact records or pull in your account data? For example, when a rep looks at a physician in the CRM, they should see that physician’s latest profile from the intelligence tool – such as affiliations, procedure stats, or “next best action” suggestions. Many modern solutions offer pre-built connectors or APIs for popular CRMs, ensuring seamless data transfer and workflow efficiency . This avoids double data entry and keeps everyone working from a “single source of truth.”

-

Marketing Automation & Outreach: If your marketing team runs email campaigns or events for HCPs, can you export or sync targeted lists from the tool? Integration with marketing platforms (Marketo, HubSpot, etc.) can help deliver coordinated, personalized outreach based on the segments the intelligence platform uncovers.

-

Analytics and BI: Some teams may want to feed the platform’s data (e.g. market metrics or target lists) into internal dashboards or analytics tools. Check if data can be accessed via API or flat file on a regular schedule for your data team to analyze further.

-

Workflow Tools: Think about where your team operates. Do they need a mobile app integration for reps on the go? In-tool notifications via Slack or email? The easier it is to access the insights in day-to-day work, the more adoption you’ll see.

In short, integration isn’t just a technical nice-to-have; it’s central to making the tool usable and “sticky” for your team. When systems don’t talk to each other, users end up with duplicate effort and often abandon one of the platforms. As one industry commentator put it, if technology isn’t simple and intuitive, it won’t get used – cumbersome, non-integrated tools lead to weak adoption by the sales force . So ensure any solution can slot into your tech stack with minimal friction, whether through native integrations or well-documented APIs. This will save you headaches and maximize the ROI of the platform.

Usability and User Adoption

Even the most data-rich platform is pointless if your team doesn’t actually use it. Busy field sales reps, regional managers, and marketing staff will only adopt a tool that genuinely makes their jobs easier. That’s why usability – the user experience, interface design, and overall intuitiveness – should be a top consideration. When evaluating HCP targeting tools, ask for demos and even trial access so your end-users can test drive the interface. Look for features like: an easy search or query builder, interactive maps or visualizations for territory views, one-click export or CRM sync, and customizable dashboards that surface the most relevant info (e.g. a rep’s “hot leads” this week).

Keep in mind that for many medtech companies, the sales team might not be very tech-heavy; a complex, technical UI could deter usage. As noted, if a tool isn’t simple and user-friendly, reps will likely ignore it . On the flip side, a tool that provides clear value – say, it quickly lists the top 10 target physicians for a product in a rep’s territory, or sends an alert when a new high-volume surgeon pops up – will gain fans.

To gauge usability, consider these aspects:

-

Training and Onboarding: Does the vendor offer training resources? A short learning curve is ideal. Some companies provide in-app tutorials or a customer success manager to help your team learn the ropes. Given that medtech salespeople are often on the road, a tool that can be learned in hours (not weeks) is preferable.

-

Interface and Speed: Is the platform sluggish and cluttered, or fast and clean? Time is money for a sales rep; they won’t wait 30 seconds for a query to load. Modern SaaS tools should feel responsive and have an interface that highlights key data (e.g. charts of procedure trends, easy filtering by specialty or geography).

-

Customization: Each company might have slightly different priorities. Can you configure the tool to display your important metrics? For example, tagging certain accounts as current customers vs prospects, or integrating your own sales data (more on that shortly). A one-size-fits-all interface may not address your unique needs.

-

Mobile Accessibility: If reps will use it on the go, check the availability of a mobile app or mobile-responsive site. Imagine a rep about to walk into a hospital, quickly pulling up that hospital’s profile and the names of key physicians – that’s powerful if available at their fingertips.

Finally, building user adoption is also about change management. As you introduce a new tool, involve your sales and marketing teams in the process. Highlight “quick win” features that directly benefit them (like saving time preparing territory plans or uncovering hidden opportunities). Share success stories of how using the platform led to a win – this can convert skeptics into advocates. And gather feedback: sometimes small usability tweaks or additional data fields can make a big difference in user satisfaction. Remember, a platform that is broadly adopted will exponentially increase the value you get from it; one that sits unused is wasted budget.

Every US physician at your fingertips. Always.

Pricing Model and ROI Considerations

For resource-conscious medtech companies, the pricing model of a commercial intelligence tool is a major factor. These platforms can be a significant investment, so you’ll want to ensure the cost aligns with the value delivered. Pricing for HCP targeting and data tools can vary widely and is not always transparent upfront. Common models include: annual subscriptions (often tiered by number of users or modules), pay-per-user licenses, or usage-based fees (e.g. based on volume of data accessed or number of records). Some vendors might charge extra for add-ons like additional data modules (such as detailed claims data or international data) or premium features (like advanced analytics or AI recommendations).

It’s important to dig into what’s included in a quote. Are you getting full access to all specialties and geographies you need, or are there limits? Will you have access to customer support and training in that price? Also inquire about any hidden costs – for example, fees for data exports, API access, or integration setup. A common frustration buyers report is the lack of transparent pricing in healthcare SaaS, where the initial quote might not reveal all the components . Don’t hesitate to ask vendors to clarify how they arrived at the price and if it can scale as you grow (e.g. is it easy to add more users later without a huge jump in cost?).

Beyond sticker price, consider the pricing structure in context of your organization:

-

Startup vs Growth Stage: A small startup medtech might prefer a lower base cost with the ability to add features later, whereas a growth-stage company with an expanding salesforce might opt for an enterprise license for predictability. Ensure the model suits your budget cycle and headcount.

-

Data Needs: If your strategy heavily relies on certain data (say, detailed procedure volumes via claims), know that these are often the cost drivers. As one analysis noted, medical claims data is costly to acquire and maintain – licensing it from clearinghouses and updating it requires heavy infrastructure . That cost is passed on to you. If you don’t need extremely granular data, maybe a more basic (and cheaper) package will suffice. Conversely, if precise procedure counts or referral data will help close sales, it may justify the premium.

-

Contract Terms: Check if the vendor offers flexible contracts or only multi-year deals. A long contract can lock in pricing (good if you expect heavy future use) but can be risky if the tool doesn’t meet expectations. Some newer providers might offer a trial period or short-term pilot before a full commitment – this can de-risk your purchase.

Ultimately, the goal is to achieve a healthy ROI (Return on Investment) from the tool. One way to frame it: If this platform helps each rep convert one additional high-value customer, what revenue would that bring? Likely far more than the subscription cost. Additionally, factor in the time saved – how much effort and salary currently goes into manual research, piecing together data from Google, public databases, or spreadsheets? Automating that through a platform can free your team to spend more time selling. In summary, weigh the cost against the potential upside. The right HCP targeting tool should pay for itself by accelerating new sales, preventing wasted spend on low-potential targets, and boosting team productivity. Still, do your due diligence on pricing details and don’t be afraid to negotiate for a model that fits your company’s stage and needs.

AI-Driven Prioritization and Predictive Insights

One of the most exciting developments in sales tech – and a buzzword you’ll encounter in 2026 – is artificial intelligence (AI). Many HCP targeting and commercial intelligence platforms now tout AI capabilities that can supercharge your targeting strategy. What does this look like in practice? Common AI-driven features include: lead scoring models that rank HCPs by likely interest or value, predictive analytics that flag which accounts are likely to convert or which territories have untapped potential, and even “next best action” recommendations (e.g. suggesting an opportune time to reach out to a doctor based on their engagement patterns).

For medtech companies trying to scale efficiently, these AI prioritization features can be game-changers. They help answer questions like: Out of thousands of physicians, who should we focus on this quarter? or Which surgeons are emerging as high referrers in my region? By analyzing vast amounts of data – historical sales, procedure volumes, physician profiles, peer influence networks, etc. – AI models can uncover patterns humans might miss. For instance, an AI might identify a mid-volume orthopedic surgeon who, based on recent referral increases and similar profiles, is about to become a heavy adopter in knee surgeries, making them a prime target for your new implant.

Industry leaders are embracing this. According to PwC, top medtech companies are equipping their field teams with “AI-driven insights and digital tools, enabling guided conversations, predictive targeting and personalized engagement.” Rather than using gut instinct or static “top X accounts” lists, sales reps get dynamically updated intelligence on where to spend their energy. Another trend is influence mapping – mapping how decisions are made across a care pathway. AI can highlight if a certain primary care doctor’s referrals heavily influence a surgeon’s volume, indicating that marketing to the referring doctor could indirectly drive device usage. These nuanced insights move you beyond simplistic targeting (like just going after the highest-volume centers) to more precision targeting that competitors may overlook .

When evaluating a platform’s AI capabilities, consider the following:

-

Transparency: AI is powerful, but also can be a black box. Does the tool explain why it’s recommending certain targets? For user trust, it helps if the platform can show some rationale (e.g. “Dr. Smith is prioritized due to high growth in XYZ procedure and peer network influence”).

-

Customization: Can the AI models be tuned to your business goals? Maybe you want to optimize for high-margin product opportunities, not just sheer volume. The best solutions let you input your criteria or at least choose from different scoring models.

-

Proven Impact: Look for case studies or metrics. For example, some vendors might claim their AI lead scoring improved rep conversion rates or that predictive targeting cut down on “wasted” sales calls significantly. A McKinsey analysis estimated that embracing AI and advanced analytics in commercial activities could strip out a huge amount of wasted effort and expense in U.S. medtech sales . While that’s broad, it underscores the potential efficiency gains.

Of course, AI is not a magic wand. It works best in tandem with quality data (garbage data will yield garbage predictions) and savvy human judgment. Ensure your team is ready to utilize AI tips – it may require training them to trust and act on the insights. But given the complex, data-rich world of healthcare sales, AI features are fast becoming a must-have rather than a novelty. They can help a lean team punch above its weight by focusing efforts where they’re most likely to yield results.

Specialty-Specific Insights and Use Case Support

Medtech is not a one-size-fits-all industry. The needs of a company selling cardiac devices differ from one selling orthopedic drills. Thus, a critical consideration is whether a targeting tool can handle the specific specialties and use cases relevant to your business. We touched on data coverage by specialty in the context of accuracy, but here we broaden the view: does the platform support the workflows and analysis that your particular commercial strategy requires?

Some examples to think about:

-

Procedure-Based Targeting: Many device sales strategies are built around specific procedures (e.g. targeting all the centers doing high volumes of cataract surgeries if you sell ophthalmic devices, or all the GI doctors performing endoscopic retrograde cholangiopancreatography if that’s your niche). Does the tool allow you to query by procedure codes or keywords and find all the physicians or facilities performing them? It’s invaluable if you can filter targets by procedure volume, as it directly ties to your product’s usage. A good platform will incorporate procedure codes (CPT, ICD-10, etc.) in its data. For instance, you might filter for all facilities performing over 500 knee replacements per year and then see which orthopedic surgeons are driving those – that’s procedure-based sales planning in action.

-

Referral and Network Tracking: In fields like cardiology or spine, referral patterns are key – a primary cardiologist refers patients to an interventional cardiologist or electrophysiologist, a general practitioner refers back-pain patients to an orthopedic spine surgeon, etc. An advanced tool can map these referral networks via claims data or affiliation data, helping you identify who the true key influencers are. For example, if Dr. Jones refers a majority of cases to a surgeon who uses your device, Dr. Jones becomes a potential advocate or a targeting point for education. Platforms that include physician affiliation and referral data can uncover such insights . This supports use cases like referral tracking and KOL (Key Opinion Leader) identification.

-

New Product Launch Planning: When preparing for a product launch, you need to quickly find early adopters. This often involves identifying thought leaders or high-volume practitioners in the therapy area. Check if the tool can provide lists of top specialists in a region, or filter by those who participate in clinical trials or publish research (some platforms integrate data on scholarly activity or conference participation). These are proxies for finding KOLs who might champion a new technology.

-

Territory Design: As your team grows, how do you carve out fair and high-potential territories? The right platform can help visualize HCP density and opportunity by geography. Some have mapping features that show where target-rich clusters are. You can then draw territory lines ensuring each rep has a balanced share of the addressable market. In fact, using data-driven territory design has been shown to boost sales performance; one study noted organizations with robust territory planning are four times more likely to hit their sales targets . A tool that can layer in demographic or regional utilization data makes designing territories far more strategic than relying solely on intuition or legacy boundaries.

-

Ambulatory vs Hospital Mix: As noted earlier, with ASC migration trends accelerating, your strategy might involve targeting outpatient centers or physician offices versus hospitals. Does the tool provide data on outpatient centers (many general healthcare databases focus on hospitals)? For example, if you sell equipment for office-based labs or ASCs, ensure the platform lists those facilities and their key physicians. The IQVIA report showed ASC procedural volumes climbing and an expectation of ~25% growth in coming years , which means a targeting tool must cover this shifting landscape to remain useful.

-

International vs Domestic: If you’re expanding globally, can the tool support multiple countries with local data? Some platforms are U.S.-centric while others have EU or global modules. MedTech Europe reports and regulatory databases might be relevant if you operate in those markets, so consider where your sales teams are located.

In essence, align the tool’s strengths with your strategic use cases. Ask vendors for specific examples in your specialty: “How would your platform help a company selling X device to Y specialists? Can you show a workflow for that?” The best solutions will have case studies or demos tailored to different scenarios (territory planning, launch, etc.) and possibly even reference customers in similar medtech segments. The more the tool feels like it “understands” your business, the faster your team can extract value from it.

Real-World Use Cases: How Teams Leverage These Tools

To bring the above points to life, let’s look at a few real-world scenarios where HCP targeting and commercial intelligence platforms support medtech commercial teams:

-

1. Territory Design & Optimization: A growing medical device company needs to assign its expanding salesforce into new territories. Using their intelligence tool, the sales ops manager maps out all potential accounts (hospitals, ASCs, clinics) in the country performing the target procedures. They discover, for instance, that certain metropolitan areas have high densities of high-value HCPs, which warrant dedicated reps, while some states can be covered by a single rep due to sparse opportunities. The platform’s data on procedure volumes and number of target physicians per area ensures each territory has roughly equal potential. This leads to more balanced workloads and avoids situations where reps are either overwhelmed or under-utilized. It also helps in setting fair quotas based on market potential, not just historical sales. Research shows that data-driven territory alignment can increase sales productivity significantly , so this use case directly impacts revenue.

-

2. New Product Launch Planning: Imagine launching an innovative spinal implant. Time is of the essence to get early traction. The marketing team uses the HCP intelligence tool to filter for spine surgeons who perform a high volume of the relevant spinal fusion procedures and who have a history of adopting new techniques (perhaps identified by their involvement in recent clinical trials or publications). They also identify which hospitals and surgery centers are doing the most of these procedures, especially in outpatient settings. With this list of top targets, they plan a focused launch campaign – reaching out to these surgeons for demos and leveraging KOLs among them to speak at launch events. Because the tool provided both the who (surgeons to target) and the where (institutions, including ASCs, with high procedure volumes), the launch can concentrate resources efficiently. The result is faster uptake in the first 6 months, which is critical for hitting launch-year sales goals.

-

3. Referral Network Tracking: A medtech company selling a cardiac device wants to boost sales in a certain region. The commercial team knows that a handful of cardiothoracic surgeons actually implant the device, but referrals come from many general cardiologists. Using the platform’s referral data, they map the network around each surgeon. They might find, for example, that Dr. A gets most patients from Cardiologist X, while Dr. B draws from a different referral base. This insight allows their sales reps to not only call on the surgeons (who are obvious targets) but also engage the referring cardiologists – perhaps by providing them educational materials or clinical data to raise awareness. As a result, the referring doctors are more likely to send appropriate patients, and the surgeons see increased volume (benefiting the device usage). Without a tool to illuminate these connections, the team might have focused only on the surgeons and missed the upstream influencers. Studies have highlighted that the classic approach of just targeting top proceduralists can miss hidden opportunities – value lies in leveraging the whole network.

-

4. Procedure-Based Targeting for Sales Campaigns: A company with a device used in colonoscopy (for gastroenterology) wants to run a targeted sales campaign to coincide with Colon Cancer Awareness month. They use the intelligence platform to pull a list of all GI physicians and colorectal surgeons in their sales territories who perform a high number of colonoscopies, especially those at outpatient endoscopy centers. They further segment the list by those who are not yet customers. The platform might also give them insight into each physician’s facility (ASC vs hospital) and perhaps quality metrics (if available). With this data, reps reach out with a tailored message (“We see you perform 1,000+ colonoscopies a year; here’s how our device can improve polyp detection in your practice…”). The campaign yields strong engagement because it was narrowly focused on relevant targets rather than a broad blast. This kind of procedure-based sales planning ensures your messaging hits the right audience at the right time, rather than casting a wide net and hoping for interest.

These examples show how a well-chosen platform can support everyday activities from strategic planning down to individual sales calls. The key is that the tool provides actionable intelligence – not just raw data, but usable insights for specific objectives. When evaluating solutions, consider walking through a scenario that mirrors your needs (e.g. “show me how I’d find the top 50 targets for X procedure in Y region”) to see if the platform truly enables those actions.

Start Your Omnichannel Strategy with Alpha Sophia

Conclusion: Making an Informed Choice

Choosing an HCP targeting and commercial intelligence tool is a significant decision that can shape your medtech company’s growth trajectory. The right choice will empower your commercial team to navigate the market with clarity – identifying where to focus, which opportunities to pursue, and how to approach each account with a data-backed strategy. A poor choice, however, could lead to wasted spend, frustrated users, and missed opportunities in a competitive field.

By focusing on the core factors outlined above – data accuracy, coverage, refresh rates, integration, usability, pricing, AI capabilities, and specialty fit – you can cut through the marketing hype and evaluate platforms on what really matters. Insist on seeing real data for your market segment, ask vendors tough questions about how they keep information current and secure, and involve your end-users in the demo process to gauge user experience. Also, look for signals of credibility and authority: does the platform cite respected sources (e.g. FDA databases, MedTech Europe reports, industry surveys) for its data? Is it mentioned positively in analyst reports or used by companies you respect? A tool anchored in authoritative data will lend credibility to your strategy when you present insights to internal stakeholders or health system customers.

Finally, remember that this is not just a software purchase – it’s a partnership. Consider the vendor’s support model and expertise in medtech. Do they understand the nuances of medical device sales strategy, or are they a generic data provider? The best providers will act as consultants, helping you get the most out of the platform and even sharing best practices (for example, how other clients optimized their territory design or tracked the impact of ASC migration trends on their sales).

In 2026’s data-rich, rapidly evolving healthcare environment, leveraging a powerful HCP targeting and commercial intelligence tool is no longer optional – it’s essential for procedure-based sales planning and precision engagement. By making a thoughtful, well-researched choice, even smaller and mid-sized medtech companies can level the playing field with larger competitors, achieving savvy targeting and efficient growth. Here’s to finding the tool that becomes your team’s secret weapon in the field, driving smarter decisions and better outcomes in the years ahead.

Sources:

-

IML – 9 Things Every Medical Device Sales Rep Should Know

https://imlasers.com/articles/9-things-every-medical-device-sales-rep-needs-to-know/

-

Intuition Labs – HCP Data Providers, Compliance & Best Practices

https://intuitionlabs.ai/articles/hcp-data-providers-compliance-and-best-practices

-

Veeva – Improving HCP Engagement (Customer Data Quality)

-

Becker’s ASC Review – Cardiology Cases Spiking in ASCs

https://www.beckersasc.com/cardiology/cardiology-cases-spiking-in-ascs/

-

Veeva – The New Rules of HCP Engagement (2022)

https://www.veeva.com/eu/wp-content/uploads/2022/06/The-New-Rules-of-HCP-Engagement\_eBook\_v5.pdf

-

ASC Data – Industry Overview (February 2025)

https://www.ascdata.com/wp-content/uploads/2025/02/ASC-Data-Industry-Overview-February-2025.pdf