Filling Physician Gaps Faster: A Guide to Smart Recruitment Using Real-World HCP Data

If you manage physician recruitment, you already know the math is brutal. Each empty chair bleeds about $8 000 a day in lost billings, locum fees, and overtime payouts.

Multiply that by the 8.4-month median search most organizations report, and the red ink deepens into seven figures before a new doctor ever sees a patient. Meanwhile, wait lists stretch, family-medicine appointments now average 31 days nationally, and your remaining clinicians edge closer to burnout.

Posting the role on ten job boards won’t save you. Nor will another round of sign-on bonuses that balloon budgets but rarely speed up time-to-hire.

The root problem is visibility. Traditional recruiting treats physicians as static résumés when, in reality, every healthcare professional generates a living data trail, including procedure counts, licensure renewals, insurance status, and even publication streaks.

In this guide, we’ll break the challenge into three steps. First, we’ll unpack the four bottlenecks that keep roles open far too long. Then we’ll show how real-world HCP data changes the script from reactive posting to proactive matchmaking. Finally, we’ll outline a pipeline model you can start implementing this quarter.

Why Physician Gaps Take So Long to Fill

The average search drags on because four separate delays stack on top of each other, and each one is solvable once you see it in data.

A National Supply–Demand Crunch

The Association of American Medical Colleges projects a shortfall of up to 124,000 physicians by 2034. That gap grows sharper in high-acuity specialties where procedure volume and liability limit training slots.

Credentialing And Payer Enrollment Lag

State boards, hospital committees, and insurers tack on 90–150 days of paperwork after the offer letter is signed. A six-month “time to contract” quietly extends into nine months before the first clinic slot opens.

Internal Decision Friction

Budget holds, scatter-shot interview panels, and unclear RVU targets slow your side of the process. A poll shows that 38% of medical groups have seen their time-to-fill stretch further in just the past year. So, delay is not only external, it’s baked into our legacy workflows.

Geography And Lifestyle Fit

Only 11% of physicians serve the 20% of Americans who live in rural areas. Even suburban hospitals feel the squeeze as candidates prioritize schedule autonomy, telehealth options, and dual-career support. A mismatch on any one of those levers can reset the entire search clock.

Taken together, these friction points explain why an open cardiology role can remain idle for nearly a year while costs continue to snowball.

But once you surface the right data, like who is nearing license renewal, who just hit a procedure milestone, and who carries portable professional healthcare liability insurance, you can intercept talent before they hit the open market. That’s where real-world HCP data changes everything.

Start Your Omnichannel Strategy with Alpha Sophia

The Power of Real-World HCP Data

Most talent lists freeze the moment you download them. Real-world data keeps yours moving. The three data layers below turn yesterday’s directory into a live, ranked shortlist.

From Static Lists To Live Intelligence

Medicare’s Physician & Other Practitioners dataset publishes procedure counts by NPI every year, down to the individual CPT® code. Pull that feed or your own billing extracts into an analytics layer, and you see who is actually placing 300 stents a year versus who last billed one in 2019.

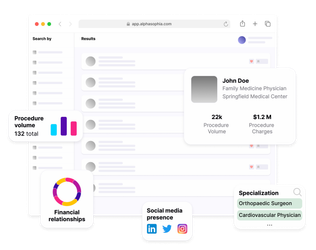

Platforms such as Alpha Sophia let recruiters filter the entire U.S. physician pool by volume thresholds, subspecialty, and geography in seconds.

Public Signals That Predict Physician Mobility

Physicians move more than most leaders realise. 62% made a major career change in just two years, and 39 % switched employers outright.

Licence renewals, new practice ZIP codes, and fresh hospital affiliations are all public records that mark the early stages of those moves. Alpha Sophia surfaces the same signals, active state licences, current group memberships, Open Payments ties, so recruiters see when a surgeon’s world is already in motion, not after the resignation letter lands.

Data Shortcuts That Reduce Credentialing Lag

Credentialing and payer enrollment still average 90-120 days for many insurers, but some candidates arrive pre-cleared for speed. Forty-one states (plus D.C. and Guam) now accept expedited licences through the Interstate Medical Licensure Compact.

By flagging “compact-eligible” physicians and feeding verified DEA numbers and license dates straight into your ATS, data-driven workflows shave weeks off the slowest mile of hiring.

When these layers converge, your morning shortlist is ranked by clinical fit, mobility, and readiness for credentialing. The result is fewer cold calls, tighter interview slates, and contracts signed before vacancy costs hit overtime. In the next section, we’ll plug this intelligence into a pipeline you can roll out this quarter.

Building a Faster, Smarter Hiring Pipeline

Data is just noise until you route it through a repeatable workflow. Below is the six-step pipeline most high-performing recruitment teams follow.

Quantify Demand Before It Hurts

Pull the last six to twelve months of scheduling or billing data out of your EHR, then layer it against CMS’s Medicare Physician & Other Practitioners file, which lists CPT-level procedure counts by individual NPI nationwide.

A single pivot table shows where your service lines are outpacing capacity. That clarity unlocks funding before overtime explodes and gives recruiters a three-month head start on any competing hospital down the road.

Once you know precisely what you need, the next hurdle is who can fill it, without sifting through thousands of stale résumés.

Build Dynamic Talent Pools

Static spreadsheets expire the moment a physician moves clinics. Instead, cast a wide net, every licensed specialist within 150 miles, and then let live data shrink it.

Feed in NPI procedure volume (e.g., “≥300 trans-aortic valve replacements last year”), recent ZIP-code changes from national address files, and active-license states pulled nightly from board websites.

As we mentioned, 62% of physicians have made a significant career change in just two years, and 39% have switched employers outright. The payoff is that your list reshapes itself each time a cardiologist joins the Interstate Medical Licensure Compact or logs a new publication.

Score For Near-Term Mobility

Weight signals that reliably precede a job move, such as a multi-state license approval, a recent drop in procedure counts, a newly issued DEA number, or a spike in locum shifts.

Algorithms can automatically knit those threads together. For example, platforms such as Alpha Sophia simply surface the top percentile rather than making you stare at spreadsheets.

Automate Personalised Outreach

A vascular surgeon who just completed a hybrid-OR CME doesn’t open “Great Opportunity” subject lines. Merge the data you already have, such as subspecialty, recent conference badges, and even preferred contact channels, into tailored messages that show you understand their world.

Recruiters using AI-guided outreach report cutting manual scheduling time by double-digit percentages while boosting response rates.

Run Credentialing In Parallel

Credentialing is the slowest step. Most hospitals wait 90–120 days for primary-source verification and payer enrollment to clear before a new doctor can bill. That delay starts only after you have a signed offer unless you push the paperwork upstream.

One proven shortcut is the Interstate Medical Licensure Compact (IMLC). Physicians who already hold an IMLC Letter of Qualification can add additional state licenses in “a matter of days or weeks,” compared with the six-month timelines many boards still post.

Flag that status in your scorecard (Alpha Sophia tags it automatically), and compliance can launch background checks while the recruiting team schedules second interviews.

Measure, Learn, Tighten

Track each funnel stage. Sourced, contacted, interviewed, and signed against benchmarks. When finance sees vacancy days trending down, support for data-driven recruiting hardens rather than fades.

A disciplined pipeline is only worthwhile if it moves the needle on real-world metrics. The next section shows what changes when the workflow above becomes standard practice.

Outcomes of a Data-Driven Approach

Data-driven recruiting is not just faster, it also reshapes every line on your operational ledger. Here is what organizations report after six to nine months of running a live-data workflow.

Time-to-Fill Collapses

Groups that front-load demand forecasting and feed live procedure, license, and mobility signals into their ATS routinely sign contracts in 90–100 days, the very timeline highlighted when one medical group replaced guesswork with a more flexible, data-enabled schedule model.

Shaving five months off search time means a physician is treating patients this fiscal year, not next.

Vacancy Dollars Stop Bleeding

A study calculates that a single gastroenterology seat left empty for six months erases $1.4 million in revenue. When you replace a 250-day search with a 100-day sprint, you recover well over half a million dollars before the books close.

Credentialing Lag Gets Pre-Solved

Traditional credentialing drags 90–150 days from signature to first clinic slot. By flagging candidates who have already been cleared through the Interstate Medical Licensure Compact, teams narrow the window to days or weeks.

Running those checks in parallel, rather than after contract, pushes first-patient dates forward by another one to two months.

Patient Access Catches Up

Every week you reclaim from recruiting and credentialing feeds directly into earlier appointment availability, lighter triage queues, and fewer referrals walking out the door.

Retention Improves Because Fit Improves

A living talent pool filters for clinical volume, geography, license agility, and even recent employer churn.

That alignment shows up later as fewer first-year exits, which is an expensive event at well over a million dollars for high-revenue specialties. When hires arrive matched on practice style and relocation readiness, they stay.

So, five metrics, including the search duration, vacancy cost, credentialing time, patient wait, and early turnover, all move in the right direction once real-world HCP data drives each stage.

Every US physician at your fingertips. Always.

FAQs

What causes delays in filling physician vacancies?

Most searches stall because there are more openings than doctors, credentialing paperwork can run three to five months, internal approvals drag, and lifestyle mismatches make rural or high-acuity roles hard to sell.

How does real-world HCP data speed up recruitment?

Live claims, licences, and mobility signals reveal who is both qualified and ready to move. Recruiters spend time on 40 high-intent candidates instead of 400 cold prospects.

Which data points matter most for fast-tracking a hire?

Key signals include current procedure volume, active-licence states, Interstate Medical Licensure Compact eligibility, recent changes in practice location, and clear compliance history.

Can this approach help in rural or niche specialties?

Yes. Dynamic pools widen the search to doctors already licensed in multiple states or those whose clinical data show experience in low-supply specialties,both critical for rural settings.

How do I know if a physician is actively open to new roles?

Early markers include new state licences, a drop in billed cases after a merger, fresh DEA registration, or a spike in locum shifts. Platforms like Alpha Sophia flag these changes automatically.

Does Alpha Sophia integrate with my ATS or CRM?

Absolutely. A REST API and pre-built connectors push every verified profile, note, and status change straight into most major systems,no manual re-entry required.

What time savings can I realistically expect?

Teams that replace manual sourcing with a data-driven workflow often cut time-to-fill from about eight months to roughly three, saving hundreds of thousands of dollars in vacancy costs.

Is the data compliant for healthcare hiring?

All information comes from regulator-approved or public sources,CMS claims, state medical boards, the NPI registry, Open Payments, and IMLC records,so every profile carries an audit trail that satisfies compliance reviews.

Conclusion

Physician shortages are here for the long haul, but drawn-out vacancies don’t have to be. Public datasets, from CMS procedure files to state-licence boards, already hold the clues to who you should hire and when.

Layer those clues into a structured pipeline, automate the grunt work, and you cut months off the calendar while saving six figures in hard costs.

The role of tools like Alpha Sophia’s is simple. It aggregates the same open-source datasets you’ve seen here, scores physicians for clinical fit and mobility, and feeds clean profiles into your ATS through a secure API, so all teams, recruiting, compliance, and finance stay in sync without extra spreadsheets.

The sooner your team trusts the data, the sooner dark exam rooms turn back into revenue-producing clinic days.