How Healthcare Leaders Utilize Market Intelligence to Stay Ahead of Competitors

Healthcare is no longer a slow-moving industry. Market dynamics shift overnight.

- Retail giants like Amazon, CVS, and Walmart are taking over primary care.

- AI-powered health-tech startups are disrupting diagnostics, patient engagement, and revenue cycle management.

- Telemedicine and value-based care have changed how providers interact with patients.

- Payers are changing reimbursement models faster than providers can adjust.

If you’re not proactively tracking market trends, patient behaviors, competitor strategies, and regulatory shifts, you’re already behind.

Healthcare leaders today can’t afford to rely on instinct or outdated reports. You need market intelligence to make fast, high-stakes decisions.

But most organizations fail at it.

In this article, we’ll talk about what market intelligence actually means in healthcare, how it differs from business intelligence, and how you can use market intelligence to drive strategy, reduce risk, and gain an advantage.

What is Market Intelligence in Healthcare?

Market intelligence is the ability to connect varied insights into a clear, competitive strategy.

Most healthcare organizations track some basic business intelligence metrics like patient volumes, payer mix, and financial KPIs. That’s not market intelligence.

Real market intelligence means answering forward-looking questions:

- Which services are seeing rising demand? (and which are becoming obsolete?)

- What pricing and payer strategies are competitors using?

- How are patients behaving differently?

- Which regulatory or policy shifts will impact reimbursement?

- What startups, acquisitions, or partnerships could threaten your market position?

Instead of guessing or reacting too late, market intelligence gives you the ability to move first.

Challenges Healthcare Leaders Face in Competitive Intelligence

Most organizations fail at market intelligence for one simple reason: they don’t have a structured system for collecting and applying insights.

1. Fragmented Data With No Centralized Strategy

Hospitals, payers, and provider groups generate massive amounts of data, but it’s scattered across different systems like:

- EHRs and clinical databases

- Payer contracts and reimbursement reports

- Competitor press releases, investor calls, and financial filings

- Government and regulatory updates

- Industry conferences and reports

But the problem is there is no unified system to bring all this together and analyze it. Without a centralized strategy, most organizations only get piecemeal insights that are too fragmented to make any meaningful decisions.

2. Market Changes Are Too Fast

If you rely on quarterly or annual reports, you’re already behind. Because by the time these reports are published, the industry has already shifted. Some examples of this could be:

- Telehealth exploded in 2021. By the time some providers acted, the demand curve had already changed again toward hybrid care.

- AI is now automating diagnostics. Many radiology and pathology groups didn’t anticipate how fast AI would integrate into workflows.

3. Tracking Competitors Too Passively

It’s not enough to know who your competitors are. Most healthcare organizations track competitors reactively, which means they notice changes after they happen. This approach is too slow.

To be able to compete, you need to know:

- What services they’re expanding into

- How they’re pricing and structuring payer contracts

- What partnerships they’re forming

- Where they’re hiring and expanding geographically

Waiting until they publicly launch something is too late. You need to anticipate moves before they happen.

4. Failing to Anticipate Regulatory & Payer Policy Shifts

Reimbursement changes can make or break entire service lines. But, many organizations don’t track these shifts early enough.

For example, new HIPAA guidelines tighten data-sharing rules. Some providers react early, while others scramble at the last minute. So, if you’re not tracking these changes proactively, you’re exposing your organization to massive risk.

The Power of Market Intelligence in Healthcare

The best healthcare leaders don’t make decisions based on gut feelings. They use market intelligence to inform strategy, reduce risk, and create an edge. Here’s how you can do it too:

1. Identifying Market Gaps Before Competitors

Growth in healthcare can only be achieved by adding the right services at the right time. The organizations that win are the ones that spot market gaps before competitors do.

Let’s say you run a hospital system, analyze demographic and claims data, and realize there’s rising demand for home-based healthcare, but no major providers are meeting that demand yet.

So, you expand home health services before your competitors do. Here, first-mover advantage is equal to market dominance. By the time competitors realize the shift in patient demand, you have already dominated the space.

2. Adjusting Service Lines for Profitability

Healthcare profitability is directly tied to payer policies, reimbursement models, and shifts in patient demand. The most successful organizations adjust their service line focus based on real-time market intelligence.

For example, if a hospital system analyzes payer reimbursements and patient volume trends and sees that urgent care centers are delivering better margins than traditional ER visits. They should shift marketing, staffing, and expansion efforts toward urgent care.

The result would be the hospital maintains profitability while competitors still rely on low-margin, outdated surgical procedures.

3. Outmaneuvering Competitors in Real Time

Most healthcare organizations only react after competitors expand into their market. The smarter approach is to track competitive moves in advance and neutralize threats before they gain traction.

4. Anticipating Regulatory & Payer Shifts

Many healthcare organizations only react to policy changes after they become law. But by then, competitors who tracked regulatory trends have already adjusted their business models.

If a provider monitors CMS reimbursement trends and sees early indications that remote patient monitoring will be reimbursed more aggressively. They should implement RPM solutions before their competitors even start looking into it.

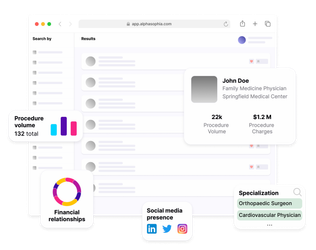

How Alpha Sophia Empowers Healthcare Leaders

Most healthcare organizations lack the internal expertise or tools to pull all of this intelligence together. That’s what Alpha Sophia helps you with.

It provides AI-driven data that helps healthcare leaders:

- Track competitors before they make a move.

- Anticipate regulatory changes before they impact revenue.

- Identify high-growth service lines before the market shifts.

Instead of playing defense, Alpha Sophia helps you make bold, proactive moves.

FAQs

1. Why is market intelligence important for healthcare leaders?

It helps healthcare leaders anticipate market changes, track competitors, optimize service lines, and stay ahead of regulatory shifts. Without it, organizations risk reacting too late and losing market share.

2. How does market intelligence help in identifying market gaps?

By analyzing claims data, patient trends, and competitor activity, organizations can spot underserved areas and expand into high-growth services before competitors do.

3. How can healthcare businesses track competitor strategies effectively?

Instead of waiting for public announcements, businesses should monitor hiring trends, facility expansions, payer contracts, and service line changes to predict competitor moves before they happen.

4. How does Alpha Sophia provide a competitive edge in healthcare market intelligence?

Alpha Sophia delivers real-time AI-driven insights that allow healthcare leaders to track competitors, anticipate regulatory shifts, and identify high-growth opportunities before the market reacts.

Conclusion

In healthcare, reacting too late means losing market share, revenue, and patient trust. The organizations that use market intelligence will dominate. Those who rely on outdated reports, slow internal processes, or gut instinct will lose ground to competitors who move faster and smarter.

You can either react to market shifts as they happen or anticipate them before your competitors do. Tools like Alpha Sophia deliver real-time, AI-driven market intelligence that ensures you make data-backed decisions ahead of the market, before competitors, before regulations shift, and before patients choose another provider.

Use Alpha Sophia Market Intelligence to Stay Ahead