How MSOs and Growth Platforms Can Use CPT Billing Data to Target Mental Health Clinics with Alpha Sophia

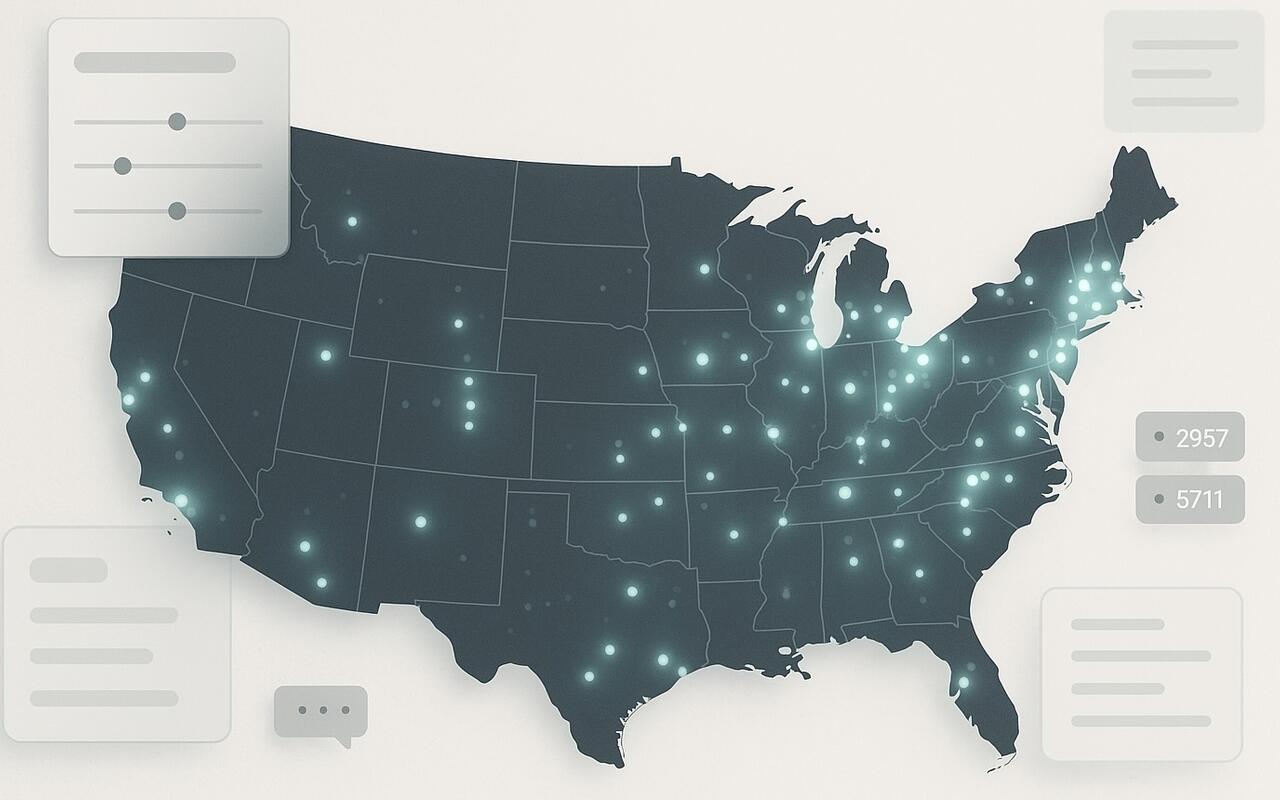

The behavioral health industry is growing aggressively, with mental health clinics becoming a core focus for MSOs, acquirers, and digital health platforms. Demand for psychiatry, therapy, addiction treatment, and virtual mental health services is rising, but the market is fragmented, making it difficult to identify scalable, acquisition-ready clinics. Traditional directories and specialty labels fail to show real performance. CPT billing data, practice-size intelligence, and geographic service density are the new key metrics for identifying high-value targets—this is precisely what Alpha Sophia makes actionable.

The Hidden Challenge in Selling Into Mental Health Clinics

Most commercial and M&A teams struggle because mental health care delivery does not behave like hospital or IDN ecosystems. Finding clinics that are both active and operationally ready for partnership or acquisition requires deeper signals than just licenses or NPI data.

Common blockers include:

-

Thousands of small private practices with no public indicators of scale or activity

-

“Behavioral health” as a label is too generic and does not represent true service volume

-

CPT billing behavior is the only reliable indicator of real service throughput and reimbursement maturity

-

Without data intelligence, outreach teams waste time on low-yield clinics that will never adopt MSO infrastructure or digital solutions

Behavioral Health MSO Acquisition Strategy: Why CPT Billing Data Matters

To evaluate mental health clinic readiness, look at behavioral CPT procedure patterns, not just specialty tags. Codes like 90791, 90832, 90834, 90837, 99214 with behavioral modifiers, and teletherapy G-codes reveal treatment frequency, session length, and visit mix. Clinics consistently billing these codes are operationally active, eligible for higher-level partnership, and prime for acquisition or tech-enabled scale support.

To see how Alpha Sophia uses billing intelligence in real commercial workflows:

→ AI-Powered HCP Targeting: How Pharma & Biopharma Drive Better Engagement

→ 11 Ways Data Analytics Is Used in Healthcare

How to Sell Into Mental Health Clinics Using Data, Not Guesswork

With Alpha Sophia, you can create a structured targeting funnel:

Step 1 — Define your ideal target clinic profile

-

Minimum provider count (e.g., 5+ active clinicians)

-

Region or metro strategy (payer landscape, shortage zones, competition density)

-

Modality priority (telehealth adoption vs. brick-and-mortar capacity)

Step 2 — Filter by CPT billing activity

-

Look for recurring behavioral CPT codes indicating high throughput

-

Identify add-on wellness or care coordination codes signaling maturity

-

Detect hybrid care through use of telehealth G-codes and mixed visit types

Step 3 — Score clinics for acquisition or enablement potential

-

High throughput + multi-provider → MSO acquisition priority

-

Moderate throughput + tele readiness → ideal for enablement or digital adoption

-

Low throughput + single provider → deprioritize or long-term nurture list

Step 4 — Map territories and expansion clusters

-

Use Alpha Sophia’s territory planning workflows to group clinics by region and assign priority tiers

-

Build go-to-market sequences around counties or metro clusters rather than lists of scattered NPIs

See the full workflow breakdown:

→ Sales Territory Planning Guide: Define, Analyze, and Convert

Step 5 — Tailor your outreach narrative

-

For acquisition: emphasize MSO stability, recruiting leverage, billing standardization

-

For SaaS/enablement vendors: show revenue lift, denial prevention, payer alignment

-

For staffing/RCM partners: identify clinics with high billing but low infrastructure

Signs a Mental Health Clinic Is Acquisition-Ready

Use this data-first checklist to determine if a behavioral health clinic should enter your priority funnel:

-

Practice has multiple active providers billing under shared group NPI

-

Billing activity includes 90791 + ongoing psychotherapy codes (not one-offs)

-

Mix includes G-codes or collaborative care codes, indicating organizational maturity

-

Located in a growth-ready metro or underserved county with payer incentives

-

Evidence of multi-location expansion or centralized scheduling

-

Telehealth codes indicate flexible operational models, ideal for MSO integration

For operator-level insight:

→ 6 Healthcare Market Insights That Drive Smarter Investment Decisions

Why Alpha Sophia Is the Ideal Tool for Behavioral MSO Expansion

Unlike static provider databases, Alpha Sophia gives you dynamic, filterable intelligence, including:

-

Behavioral CPT billing density by clinic

-

Real practice size and provider stack

-

Multi-format search (clinic name, geography, service volume)

-

Export-ready leads for acquisitions, outreach, or recruiting

-

Territory and cluster-building workflows for BD and integration teams

This transforms acquisition sourcing and go-to-market planning from manual research into a repeatable data workflow.

Related:

→ How to Use Alpha Sophia for Physician Recruitment & Specialty Practice Growth