How to Sell Medical Devices in Emerging Markets

Selling medical devices in emerging markets is both an opportunity and a challenge.

On the one hand, you have massive growth potential. On the other, regulatory red tape, price-sensitive buyers, and fragmented distribution networks can stall even the best products.

If you’re a medical device company looking to expand into emerging markets, you need much more than a good product. You need a strategy that considers everything from regulatory approvals to local partnerships and distribution networks.

In this article, we’ll break down the key challenges, winning strategies, and how some tools can help identify high-value prospects.

What is an Emerging Market?

“Emerging markets” is a term that refers to an economy that experiences considerable economic growth and possesses some, but not all, characteristics of a developed economy. Emerging markets are countries that are transitioning from the “developing” phase to the “developed” phase.

The Challenges of Selling Medical Devices in Emerging Markets

Most medical device companies underestimate just how different selling in emerging markets is compared to developed ones.

If you don’t adjust your approach, you’ll find yourself stuck in regulatory limbo, unable to convince hospitals to buy, or dealing with distributors that never deliver.

1. Regulatory Hurdles

Unlike the FDA (U.S.) or the EMA (Europe), which have structured, albeit lengthy, approval processes, emerging markets vary dramatically in their regulatory rigor.

Some countries require local clinical trials, while others accept CE or FDA approvals but impose additional bureaucratic layers. And then there are the “grey areas” where requirements aren’t clear until you’re knee-deep in the process.

For example, China requires registration with the National Medical Products Administration (NMPA), but approval can take years unless you partner with a local firm.

Brazil’s ANVISA imposes different requirements depending on the device classification, and the approval timeline can be highly variable.

The biggest mistake companies make is treating all emerging markets the same. You need local regulatory experts or risk spending years trying to get through the door.

2. Pricing and Reimbursement Challenges

In many emerging markets, the U.S. model of high-priced medical devices covered by insurance doesn’t apply. Many hospitals and clinics rely on government tenders, local procurement networks, or direct cash purchases, and they are incredibly cost-sensitive.

Even premium hospitals that want high-end technology often have limited budgets and will negotiate aggressively. So, without a clear understanding of how hospitals, clinics, and patients pay for devices, you risk pricing yourself out of the market.

3. Infrastructure and Distribution Bottlenecks

One of the hardest parts of selling in emerging markets is getting your devices into hospitals in the first place. Poor logistics infrastructure, customs delays, and a fragmented supply chain can make it extremely difficult.

Some regions also struggle with inadequate healthcare infrastructure. If you want to sell an advanced imaging device to a hospital that lacks stable electricity or trained radiologists, it is going to be a tough sell.

4. Trust and Adoption Barriers

In emerging markets, doctors and hospital administrators often stick with what they know. Even if your device is superior, you must overcome trust barriers before they’ll switch.

So, if you’re new to the market, expect a longer adoption cycle. Doctors, hospital administrators, and procurement officers will need assurance that your product is reliable, cost-effective, and supported by proper training and service.

Winning Strategies for Selling Medical Devices in Emerging Markets

Despite these challenges, many companies successfully enter and thrive in emerging markets. Here’s how you can do it, too.

1. Master the Regulatory Process

One of the biggest mistakes medical device companies make is underestimating the complexity and variability of regulatory approvals in emerging markets. The key is working with local regulatory experts who understand the nuances of the country’s approval process.

Before entering a new market, check if you can use existing certifications such as FDA or CE marking or if you need to go through country-specific approvals.

Some markets, like Saudi Arabia and Brazil, allow fast-tracking if a device already has approval in major markets, while others require entirely separate compliance steps.

Moreover, factor in regulatory timelines into your market entry strategy. Approvals can take anywhere from a few months to several years.

2. Develop Market-Specific Pricing

Price sensitivity and purchasing flexibility are two of the main challenges in new markets. Many hospitals want access to high-quality devices but simply can’t afford premium pricing models. If you try to sell a high-end MRI scanner at full price in a market where budgets are limited, you won’t get far.

So, you need to be creative with pricing and financing options. You can explore:

-

Leasing and rental models: Instead of requiring hospitals to make large upfront purchases, offer them a lease option. This takes away the burden of heavy capital investment.

-

Pay-per-use models: It’s particularly effective for diagnostic equipment. You can charge hospitals based on usage to justify the expense.

-

Tiered pricing: Offer different models at various price points so that hospitals can choose what fits their budget and needs.

3. Build a Strong Local Distributor Network

Local distributors understand the local market, have existing relationships with hospitals and doctors, and even provide on-the-ground sales and service support. But many carry dozens of products and may not prioritize yours unless there’s a clear incentive.

So, vet distributors on the basis of your target hospital, experience, post-sales support, etc. Once you have the right distributor, invest in training them well.

If doctors and hospital staff feel confident using your device, they are more likely to recommend it to others.

5. Localize Your Marketing and Sales Approach

A sales strategy that works in the U.S. or Europe won’t necessarily translate to an emerging market. Language barriers, cultural nuances, and buyer motivations vary widely.

Some markets prefer face-to-face interactions, while others respond well to digital outreach. For example, in some African and Latin American countries, even WhatsApp works as a key communication tool.

How Alpha Sophia Can Help Identify High-Value Prospects

One of the biggest challenges in selling medical devices in emerging markets is finding the right hospitals, doctors, and healthcare providers who are most likely to need and adopt your product.

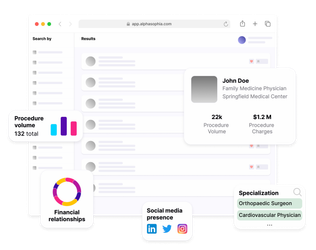

Here’s where AI-powered tools like Alpha Sophia can give you a major advantage. Instead of relying on outdated sales tactics like cold-calling hospitals, attending random trade shows, or waiting for inbound inquiries, Alpha Sophia helps you to take a data-driven approach to prospecting.

With Alpha Sophia’s commercial intelligence platform, you can:

- Filter prospects by medical specialization, location, and procedure volume.

- Identify top healthcare providers performing procedures related to your device.

- Understand hospital purchasing trends and procurement processes.

- Streamline outreach to the right decision-makers.

By using data-driven insights, you can prioritize the best sales opportunities, reduce time wasted on low-potential leads, and increase your chances of closing deals in new markets.

Leveraging Technology for Expansion

Selling medical devices in emerging markets often means overcoming logistical hurdles, limited in-person access to hospitals, slow-moving procurement cycles, and the challenge of building trust in unfamiliar regions.

The right technology can help you overcome these barriers to move faster and sell smarter.

1. Virtual Sales & Demonstrations

In-person sales calls aren’t always feasible, and some hospitals may hesitate to engage with new suppliers.

In such cases, virtual product demonstrations, remote training sessions, and digital onboarding tools help you showcase your devices, educate doctors, and also address concerns.

2. Predictive Market Insights

AI-powered tools, like Alpha Sophia, can help you predict where demand is growing, which hospitals are investing in new technology, and which physicians are most likely to champion adoption.

This is a huge asset if you don’t want to waste effort and make sales more targeted and effective.

3. Streamlined Lead Tracking

Instead of relying on cold calls and broad outreach, you can use CRM tools to track engagement, follow up strategically, and nurture relationships with genuine decision-makers.

FAQs

Why should medical device companies expand into emerging markets?

These markets are experiencing rapid healthcare growth, increasing investment, and a rising demand for advanced medical technology. Entering now means establishing an early market presence before competition heats up.

How can companies navigate regulatory approvals in emerging markets?

The best approach is to work with local regulatory experts who understand the approval process in each country. Obtaining internationally recognized certifications, such as CE marking, can also streamline approvals in multiple regions.

What role do local distributors play in medical device sales?

Local distributors provide market access, logistics support, regulatory guidance, and established relationships with hospitals and clinics. Partnering with the right distributor can make a significant difference in accelerating sales and market penetration.

What are the best marketing strategies for reaching healthcare buyers in emerging markets?

Host hands-on training, use key opinion leaders (KOLs), and provide strong after-sales support. Many hospitals also respond well to flexible financing options and outcome-based sales models.

Conclusion

Selling medical devices in emerging markets isn’t a plug-and-play strategy. So, the ones that succeed are the ones that understand local regulatory processes, adapt pricing to fit economic realities, invest in physician trust, and work with the right distributors.

The biggest mistake is going in blind. Instead, if you use data-driven insights like those from Alpha Sophia, you can pinpoint the right hospitals and decision-makers, saving time and cutting through inefficiencies.

Use Alpha Sophia to find medical practices