Locum Tenens Recruitment in 2025: Matching Short-Term Needs with Long-Term Data Strategy

If you oversee physician staffing in 2025, you’re running two races at once.

The first is the daily sprint to plug a rota hole before patient satisfaction nosedives. The second is a marathon of workforce planning against shortages, the AAMC now pegs at up to 86,000 doctors by 2036, a deficit that isn’t going away on its own.

Meanwhile, the locum tenens market keeps swelling. Following a 17 percent increase in 2023, U.S. locum revenue is projected to rise by 5 percent in 2025.

About 52,000 physicians, roughly 7 percent of the active workforce, now take at least one locum assignment each year.

Those numbers explain why you need locums in your playbook. What they don’t explain is why matching the right doctor to the right shift still feels like juggling chainsaws. Let’s unpack the frictions first, then look at how a data-driven approach helps you stay ahead.

The Challenges of Locum Tenens Recruitment Today

Finding locums hinges on three key variables: speed, fit, and cost. All three are under strain.

Time To Fill Is Still Too Long

Permanent searches remain slow. The 2024 AAPPR benchmarking report reports median “search-launch-to-contract” times ranging from 77 to 228 days, depending on the specialty.

Locums are meant to close those gaps, but locating candidates and moving them through onboarding often consumes weeks that hospitals do not have.

Credentialing Adds Weeks, Sometimes Months

Primary-source verification, payer enrollment, and committee reviews typically extend 60 to 120 days, and longer if documentation arrives piecemeal. Delays at this stage turn many “urgent” placements into non-starters.

Rates Continue to Climb

In a tight market, pay escalates quickly. Staff Care lists $160–$245 per hour for emergency-medicine locums; other high-demand specialties trend higher.

Without real-time benchmarks, finance teams risk overpaying simply to keep doors open.

Rural Sites Are Hardest to Cover

Chartis Center for Rural Health counts 182 rural hospital closures since 2010 and says 46 percent of those remaining operate at a loss.

The thin supply of clinicians willing to travel or relocate makes coverage for these facilities especially fragile.

Recruiter Capacity Is Stretched

Median compensation for a locum-tenens recruiter hovers near $40,000 per year, and turnover remains high.

When experienced recruiters leave, every open requisition resets, and cycle times lengthen again.

Taken together, slow searches, paperwork bottlenecks, escalating rates, and limited recruiter bandwidth create a feedback loop that keeps organizations on the defensive. Breaking that loop requires stronger intelligence, not more advertising.

Start Your Omnichannel Strategy with Alpha Sophia

Why a Long-Term Data Strategy Matters

Posting a job ad fixes Friday night, but it does nothing for the six-month surge you already see coming. A durable data spine does three things your inbox never will.

Anticipate Demand

Blend license-renewal calendars, RVU trends, and seasonal census spikes, and hot spots flash six months early instead of six days.

When licensing-renewal dates, historical census swings, and procedure volumes are pooled into one dashboard, recruiters can see which service lines will hit redline months ahead, not days ahead. Early warning turns reactive, last-minute searches into scheduled, proactive sourcing.

Verify Readiness Fast

Credentialing is the slowest leg of the race: primary-source checks, payer enrollment, and committee reviews typically add 90-120 days to a placement.

Digital credential wallets that surface only “verification-ready” clinicians prevent good candidates from stalling in paperwork and shorten the overall cycle.

Optimize Pricing

Live rate dashboards let finance teams compare quotes against regional medians before they sign, guarding budgets from overpayment when supply tightens. Aligning offers with current market medians protects budgets without sacrificing speed.

Close the Feedback Loop

Modern provider graphs track post-assignment data like readmissions, procedure counts, and patient-experience scores, so every completed contract refines the next search. Continuous feedback turns locum staffing from an ad-hoc expense into a measurable, performance-driven process.

With data that anticipates, verifies, and optimizes, teams stop firefighting and start executing a plan the CFO can budget for and clinicians can trust. Next, we’ll dive into how Alpha Sophia puts those levers into practice, so your weekend gets covered without losing sight of next quarter’s staffing goals.

How Alpha Sophia Supports Smart Locum Recruitment

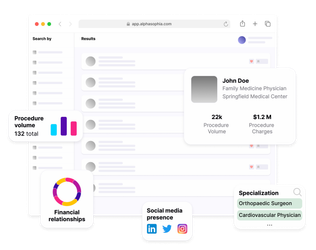

Alpha Sophia’s data engine starts with a nationwide graph of millions of licensed clinicians that can be sliced and diced by niche attributes like specialty, procedure codes, payer mix, hospital affiliations, and even recent billing patterns.

Pinpoint Active, Clinically-Relevant Candidates

The platform lets you filter for physicians who are actively billing the exact CPT or HCPCS codes your shift demands. Need an internist comfortable with high-acuity inpatient work?

Filter for recent critical-care procedure claims and exclude office-only billers.

License & Credential Visibility Up Front

Alpha Sophia ingests license feeds and historical credential data regularly, giving you early visibility into potential license gaps like lapsed or single‑state coverage, before outreach begins.

That prevents a common failure mode, which is discovering credential issues after the offer letter.

Rural-Ready Sorting

Because practice-setting metadata and billing context are stored alongside credentials, you can surface physicians with prior experience in critical-access hospitals or solo night coverage, exactly the profiles rural sites struggle to secure.

Live Market Signals for Faster Outreach

Industry surveys show nearly half of physicians (46%) pick up locum assignments to supplement income when their primary practice volume slows, often after a lull in elective procedures. Alpha Sophia’s analytics surface these billing changes so you can spot emerging availability sooner than you could with static rosters.

Taken together, these functions shrink short-lists, remove credential surprises, and bring rural or high-acuity candidates into view, advantages that are hard to match with legacy job boards or manual rosters.

Aligning with Broader Workforce Goals

A slick sourcing tool is only half the solution. Executives still need hard numbers to justify every locum hour, prove quality gains, and keep access promises, especially as margins tighten. Below is how a data-driven approach turns day-to-day recruiting wins into organisation-wide value.

Quantify the Financial Impact of Vacancies

Vacant seats bleed revenue long before quality is affected. Alpha Sophia’s vacancy-cost widget shows that exposure alongside real-time candidate supply, so finance, HR, and clinical leaders agree on how quickly a role must close and what resources justify the speed.

Use Market-Rate Intelligence to Control Spend

Locum rates move quickly, especially in high-demand services. AMN Healthcare’s 2024 guide lists US $160–245 per hour for emergency-medicine locums.

With real-time benchmarks on screen, negotiators can compare incoming quotes to the local 50th, 75th, and 90th percentiles before signing. If paying US $190 an hour to cover a 120-hour block (≈ US $22 800) prevents a US $150 000 monthly vacancy loss, the ROI is obvious and now documented.

Link Staffing Choices to Quality and Rural-Access Targets

Alpha Sophia tags clinicians by prior critical-access experience, quality scores, and patient-experience ratings. Recruiters can therefore prioritize candidates who stabilise care in fragile markets while still satisfying CMS quality benchmarks.

Post-assignment metrics, readmissions, case volumes, HCAHPS, flow back into the same graph, ensuring future short-lists favour providers who delivered strong outcomes.

With vacancy cost, live rate data, and outcome feedback in one place, locum hiring stops being a last-minute expense and becomes a planned investment in access, quality, and fiscal health, the exact alignment C-suite leaders demand in 2025.

Find any and every HCP, not just the ones looking for a job

FAQs

What is locum tenens recruitment, and why is it still relevant in 2025?

Locum tenens recruitment is the practice of sourcing, credentialing, and placing clinicians on temporary contracts to keep services running when permanent staff are unavailable. With the physician workforce shrinking and patient demand growing, short-term coverage has become a mainstay for hospitals that cannot afford service interruptions.

What challenges do healthcare organizations face in hiring locum physicians?

Hospitals often struggle with lengthy search cycles, credentialing delays that can stretch beyond two months, rising hourly rates for high-demand specialties, and persistent shortages in rural regions where clinicians are least inclined to travel. These factors compound to drive up costs and extend vacancies.

How does HCP data improve locum matching and placement speed?

A unified data platform lets recruiters filter the entire provider pool by active licenses, recent procedure codes, and travel radius in seconds. Because the system excludes clinicians with lapsed credentials, short-lists are smaller yet yield higher success rates, cutting days or even weeks from outreach and onboarding.

Can data tools like Alpha Sophia help with credentialing and compliance?

Yes. Alpha Sophia integrates with digital credential wallets, so recruiters see a clinician’s license status, malpractice history, and specialty certifications in one view. Offers are extended only to candidates who are ready to pass hospital privileging, eliminating last-minute surprises.

How does a data strategy reduce hiring costs for short-term coverage?

Vacancy-cost calculators show leadership how much revenue each unfilled position forfeits every day. When this figure is displayed next to real-time hourly market rates, it becomes clear that paying a premium for temporary coverage still saves money compared with leaving the role vacant.

How can I identify locums who are open to rural or high-need areas?

Filtering for previous work in critical-access hospitals, active multi-state licenses, or telehealth certifications quickly surfaces clinicians who have already demonstrated geographic flexibility and are therefore more likely to accept rural assignments.

What’s the difference between using a data platform vs. a traditional job board?

Job boards rely on self-reported profiles that can go stale quickly. A data platform refreshes licensing feeds daily, ingests new billing activity, and alerts recruiters to compliance gaps automatically, producing smaller, more accurate candidate pools and faster placements.

How can locum recruitment align with long-term staffing goals?

Modern platforms track post-assignment performance metrics such as readmissions and patient-experience scores. By feeding those results back into workforce planning dashboards, hospitals can identify high-performing locums for future contracts or permanent roles, turning short-term fixes into a pipeline for long-term talent.

Conclusion

Short-term coverage and long-term workforce health no longer need to pull in opposite directions.

By combining vacancy-cost modelling, real-time rate benchmarks, and outcome feedback in one data spine, Alpha Sophia turns locum staffing into a strategic lever, closing revenue leaks, protecting care quality, and giving leadership hard numbers instead of hunches.

In a market where every unfilled shift and every overspent dollar count, data-driven locum recruitment is no longer optional, it is the operating standard for 2025 and beyond.