Optimizing Your Sales Strategy in MedTech: Using Data to Target the Right Buyers

If you’ve spent any time in MedTech sales, you know the rules are different here. It’s not software where you can close a deal over Zoom in two weeks. It’s not traditional B2B, where pricing and features drive decisions.

In MedTech, sales cycles stretch for months or even years. Buying decisions aren’t made by a single person, but by a complex web of stakeholders.

This is why so many MedTech sales teams struggle. They’re selling as if the problem is awareness when, in reality, the problem is alignment.

The most successful sales teams today are using data to sell at the right time, to the right people, and with the right message.

In this article, we’ll walk through exactly how to optimize your MedTech sales strategy using data so you can sell smarter, close deals faster, and outmaneuver the competition.

Understanding the Ideal Buyer Profile in MedTech

One of the biggest mistakes MedTech sales teams make is assuming that every hospital, clinic, or healthcare facility is a potential buyer.

Yes, your device may improve outcomes, streamline workflows, or reduce costs, but if the facility isn’t in a position to buy, none of that matters.

In MedTech, the difference between a good sales strategy and a great one is knowing exactly which buyers are ready, willing, and able to make a purchase. This means looking beyond surface-level demographics and identifying real buying signals that indicate a deal is possible.

Who Are the Right Buyers in MedTech?

An ideal buyer is not any hospital or clinic that could theoretically use your device. It’s one that meets specific criteria that increase the likelihood of a sale.

These include:

- A clear clinical need

- Budget and financial readiness

- A key decision-maker pushing for a solution

- A competitive opening

- Operational readiness

Without these elements, a lead may look promising on paper but ultimately stall during the sales process.

Using Data to Identify & Prioritize Sales Opportunities

Once you’ve identified who your ideal buyers are, the next challenge is figuring out which opportunities to pursue first.

In MedTech sales, the best opportunities are about timing. The difference between a deal that moves quickly and one that drags on for months (or dies altogether) often comes down to whether you’re engaging when the conditions for a purchase are right.

Why Prioritization Matters in MedTech Sales

Sales teams only have so much time in a day. If reps are spending weeks chasing the wrong accounts, they’re missing out on real opportunities elsewhere.

Instead of treating every lead the same, use data to separate high-priority prospects from low-value ones.

For example, a hospital that matches your profile but is locked into a vendor contract for two more years is a long-term nurture opportunity, not a focus for this quarter.

Using Data to Pinpoint the Best Sales Opportunities

Don’t rely on gut instinct to decide where to focus. Use real-world data to track the market and identify which accounts are most likely to buy and when.

Here’s how:

Track Procedure Volumes in Key Specialties

If a hospital is performing an increasing number of robotic surgeries, they’re more likely to need robotic surgical tools and accessories.

Monitor Capital Expenditures & Funding Announcements

Hospitals receiving new capital funding or grants often have pre-approved budgets for equipment purchases.

Identify Competitor Contract Expirations

If a hospital just signed a five-year deal with your competitor, your chances of winning that business right now are slim. But if their contract expires in 12 months, now is the time to start engaging, so you’re positioned ahead of renewal negotiations.

Use Lead Scoring to Prioritize Engagement

Instead of treating every lead equally, assign a lead score based on factors like:

- Recent engagement with your content

- The hospital’s financial health and capital spending trends

Leveraging AI & Data Analytics to Improve Sales Targeting

Too many MedTech sales teams rely on static CRM lists, outdated buyer assumptions, and cold outreach that leads nowhere. The problem is the timing.

The key to closing deals faster is a lot more than knowing who might be fit. You need to know who is actively moving toward a purchase. This is where AI and data analytics make a measurable impact.

Instead of chasing hospitals that “could be interested,” you can use AI to:

- Pinpoint which hospitals are entering a buying cycle based on procedure volumes, funding patterns, and market shifts.

- Engage decision-makers when budgets are open and contracts are expiring.

- Deliver precise, data-backed messaging that aligns with a hospital’s real priorities.

1. Detecting Early Buying Signals

AI identifies subtle shifts that indicate a hospital is entering an evaluation phase, such as:

- Increases in procedure volume suggest a need for better tools.

- The hiring of new clinical specialists who may drive technology adoption.

- Public funding announcements or capital expenditures that indicate budget availability.

2. Mapping Decision-Maker Influence

Most MedTech sales teams struggle to identify who really makes the purchase decision. AI solves this by analyzing:

- Previous purchasing behaviors in similar hospitals.

- Procurement and finance involvement levels across deals.

- Which departments hold budget authority for specific categories of devices.

Rather than wasting months pitching the wrong people, you can engage the entire decision-making team early and remove obstacles before they arise.

3. Precision Targeting & Personalized Outreach

AI ensures that your outreach is hyper-relevant by factoring in:

- Competitive intelligence

- Hospital priorities

- Financial patterns

This leads to higher response rates, faster sales cycles, and better close rates.

Overcoming Sales Challenges with Data-Driven Strategies

MedTech sales cycles are long for a reason. Hospitals don’t make quick purchasing decisions, and even when the clinical team is on board, deals stall due to procurement red tape, financial pushback, and internal politics.

The difference between a sales team that struggles to get deals across the finish line and one that closes efficiently comes down to how well they anticipate and eliminate these obstacles before they slow things down.

You can use data-driven strategies to stay ahead of the process instead of reacting when a deal stalls.

- Track capital expenditures, funding cycles, and past purchasing behavior to see which hospitals are actually in a position to buy.

- Engage procurement and finance early.

- Know when hospitals are evaluating alternatives.

- Map internal decision-makers upfront.

- Use real-time engagement data to push deals forward.

Without a data-driven strategy, deals will keep stalling for reasons that you could have predicted and prevented.

Actionable Steps for Sales Leaders

Most MedTech sales teams say they’re using data, but few actually build their strategy around it. If your team isn’t using data to guide who to engage, when to engage, and how to position the deal, you’re operating at a disadvantage.

Here’s how to fix that:

1. Stop Letting Reps Waste Time on Accounts That Won’t Close

Disqualify hospitals without a budget. A facility that hasn’t purchased capital equipment in years is unlikely to suddenly make an exception for you. You should be targeting hospitals that are actively spending in your category.

Track competitor contract cycles and prioritize facilities expanding in your space.

2. Fix the Procurement & Finance Bottleneck

Map the approval process in advance. In complex IDNs and hospital systems, deals don’t move forward until multiple levels of approval happen. So, your team should know exactly who needs to sign off and where the biggest risk of pushback is before the deal even gets to procurement.

3. Shift Sales from “Activity-Based” to “Buyer-Readiness” Targeting

Track conversion rates by buying signals. If a rep books 20 meetings but none of them convert, they aren’t targeting well. If another rep books five meetings and two turn into late-stage deals, they’re selling smarter.

Align messaging with what decision-makers actually care about. If your team is delivering the same pitch to all stakeholders, you’re losing deals before they start.

4. Stop Running Sales & Marketing in Silos

Marketing should identify the same buying signals as sales. If sales is targeting accounts based on budget cycles and funding approvals, marketing should be generating inbound interest from those same facilities.

FAQs

Why is a data-driven sales strategy important for MedTech companies?

A data-driven strategy helps sales teams focus on hospitals that are actually ready to buy, reducing wasted effort and improving win rates.

What types of data should MedTech sales teams focus on?

Sales teams should track budget approvals, contract expirations, procedure volume trends, and funding announcements.

How can predictive analytics improve sales targeting?

Predictive analytics identifies which hospitals are most likely to buy soon based on past purchasing behavior, procedural growth, and funding trends.

How can AI and automation enhance MedTech sales strategies?

AI helps reps prioritize leads, track engagement signals, and time outreach effectively.

What role does compliance play in MedTech sales strategies?

Sales teams must follow strict regulations on physician interactions, product claims, and marketing practices.

How can MedTech companies measure the success of a data-driven sales strategy?

The real measure of success is conversion rates, deal velocity, and forecast accuracy.

Conclusion

If you’re still relying on broad outreach and intuition to sell in MedTech, you’re wasting time. Hospitals don’t buy because a product is innovative. They buy when the budget is available, procurement is aligned, and financial decision-makers see clear value.

You can’t afford to chase every hospital that fits your ideal customer profile. Most won’t be ready to buy. The only way to close deals faster is to identify who is in a buying cycle and align your sales process with how hospitals actually make purchasing decisions.

So, if you aren’t selling with precision, you’re losing to teams that are. The only question is whether you’ll adapt before it’s too late.

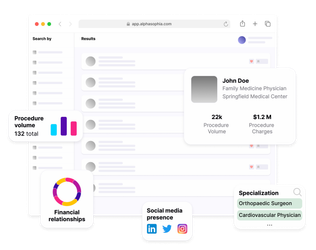

Use Alpha Sophia to find medical practices