Profiling Healthcare Providers: How Sales Teams Can Personalize Outreach with Data

Reaching healthcare providers has never been more challenging. Physicians today are busier than ever, juggling patient care, administrative work, and evolving healthcare regulations.

Many are also limiting access to sales reps. Some reports suggest that over 60% of HCPs now fall into the “no-see” category, meaning they rarely take in-person meetings with sales reps.

For sales teams, this presents a serious problem. How do you connect with providers when traditional sales tactics no longer work?

The answer lies in healthcare provider profiling, which is a data-driven approach that helps sales teams understand which HCPs to target, what they care about, and how to engage them.

In this article, we’ll break down the importance of healthcare provider profiling, the key data points that matter, and how sales teams can use this information to drive smarter, more effective outreach.

The Need for Data-Driven Sales in Healthcare

For years, healthcare sales worked on relationships. Reps could walk into a doctor’s office, drop off some samples, and have a conversation. That’s not the case anymore.

Today, most physicians have packed schedules, EHRs have taken over their time, and many simply don’t meet with sales reps like they used to.

So, that makes one thing clear. If your sales team is still relying on the old approach, they’re wasting time. You can’t afford to make random calls and hope someone picks up. You need to know exactly which providers are worth targeting, what they care about, and how they prefer to engage.

This is why healthcare sales teams are shifting to data-driven provider profiling.

When you understand a provider’s prescribing habits, patient demographics, institutional affiliations, and even preferred communication methods, you stop being another sales pitch in their inbox. You become a resource.

What Data Matters in Profiling Healthcare Providers?

Sales teams often drown in numbers, collecting everything from a doctor’s graduation year to their favorite conferences, without knowing what actually helps them sell better. The truth is that most of this information is of no help.

So, what exactly should you be looking at?

Practice Type & Setting

A provider’s practice environment determines how much independence they have. A doctor in a private practice makes individual decisions, while one in a hospital system follows institutional guidelines.

If you’re selling a new therapy, a solo-practice physician might adopt it faster, while a hospital-based provider may need approval from a committee.

Prescribing Behavior

You need to know who actually prescribes treatments in your category, how often, and whether they’re loyal to a specific brand. If a physician never prescribes your type of drug or device, they may not be worth pursuing, or they may need an education-first approach.

Patient Volume & Demographics

A provider who treats 200 patients a month in your therapeutic area is a far better lead than one who sees 20. And patient demographics also matter.

Decision-Making Influence

If a doctor is an early adopter or a Key Opinion Leader (KOL), convincing them can drive uptake across an entire health network. On the other hand, if they have little decision-making power, your real target might be their institution, hospital committee, or medical director.

Communication & Engagement Preferences

You can have the perfect sales message, but if you send it in the wrong format, it won’t land. Some doctors prefer peer-reviewed studies, while others respond better to quick, digestible updates.

Data Sources for Healthcare Provider Insights

One of the biggest mistakes sales teams make is relying on a single dataset to understand providers. No healthcare provider operates in isolation, their decisions all come from different, sometimes hidden, factors.

That’s why the smartest way is to layer the data, pulling from multiple sources to create a complete picture of your target providers.

There are three primary sources for healthcare provider data: public databases, commercial data providers, and real-world engagement insights.

1. Public Databases & Government Records

Government sources provide foundational data on providers, including their licensing, practice location, and specialty. These are useful for validation but often lack real-time updates.

2. Commercial Healthcare Data Providers

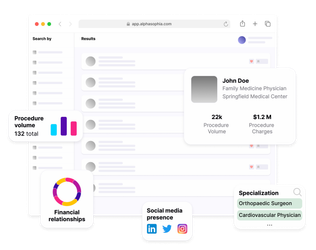

Companies specializing in healthcare analytics, like Alpha Sophia, provide much deeper insights, including prescribing habits, patient volume, affiliations, and decision-making influence.

3. Real-World Engagement & First-Party Data

Data from actual interactions with providers is often the most valuable but least used. CRM systems, email marketing metrics, and event participation records give a real insight into how a provider engages with your company.

Segmentation Strategies for Sales Teams

Most sales teams make the mistake of treating all healthcare providers the same. They send the same message to a high-volume prescriber and a low-engagement physician. They pitch a specialist the same way they would a primary care doctor.

Instead of treating all providers in the same way, segmentation allows you to group them based on behavior, influence, and prescribing patterns so that your outreach is targeted, relevant, and impactful.

There are many ways to categorize healthcare providers, but the most practical segmentation strategies are based on:

Prescribing Behavior Segmentation

Some providers are high-volume prescribers in your category, while others rarely or never prescribe similar treatments. Segmenting providers based on their actual prescribing history, you can focus on high-opportunity targets instead of wasting time on physicians who are unlikely to engage.

Influence-Based Segmentation

Knowing whether a provider is a decision-maker or a decision-follower helps focus efforts in the right place.

Engagement-Based Segmentation

Some providers respond best to clinical research and data-driven discussions. Matching your outreach methods to a provider’s preferred communication style makes it more likely to progress into a meaningful engagement.

While segmentation makes outreach more effective, manually sorting providers into categories is time-consuming and error-prone. This is where solutions like Alpha Sophia make a real difference.

How to Personalize Outreach Based on Data

Segmentation helps sales teams understand who to target, but personalization is what makes outreach effective.

The key to true personalization is using data to shape how, when, and what you communicate. Here’s how:

Timing

A provider is more likely to engage when they’re actively considering a new treatment, not months before or after. If they’ve recently prescribed a similar drug or attended a medical conference on the topic, that’s a signal they’re open to learning more.

Messaging

Some providers respond best to clinical trial data, while others care more about patient case studies or cost-effectiveness. You need to identify which angle would work best for them.

Channel

A provider who engages with digital content might prefer a follow-up email, while another who only attends in-person conferences may require a different approach.

Future Trends in Data-Driven Sales for Healthcare Providers

Healthcare sales is shifting from broad, transactional outreach to precision-driven engagement. So, the future belongs to sales teams that know how to use data. Here’s where things are headed:

-

AI-powered tools are now analyzing real-time prescribing shifts, patient demographics, and engagement trends to identify high-value providers.

-

The best outreach will be driven by real-time triggers, such as a provider attending a medical conference, changing prescribing habits, or engaging with a new study.

-

AI will help predict what kind of information will influence a provider the most before outreach even happens.

-

Instead of spending hours sifting through reports, reps will get clear, actionable recommendations on which providers to target and how.

FAQs

What is healthcare provider profiling, and why is it important for sales teams?

Healthcare provider profiling helps sales teams understand who they should target, how providers make decisions, and what influences their prescribing behavior.

What types of data are useful for profiling healthcare providers?

The most valuable data includes prescribing trends, institutional affiliations, decision-making influence, and engagement behavior.

Where can sales teams find reliable data on healthcare providers?

Reliable data comes from multiple sources. Public databases provide foundational details, commercial datasets reveal prescribing patterns, and real-time engagement tracking shows how providers interact with content.

How can sales teams segment healthcare providers for targeted outreach?

Segmentation should go beyond basic demographics. Providers can be grouped by prescribing behavior, influence level, and engagement preferences.

How does AI help in profiling healthcare providers?

AI makes profiling smarter by analyzing real-time data rather than relying on outdated lists. It can detect shifts in prescribing behavior, predict when a provider is likely to engage and recommend the best messaging approach.

What challenges do sales teams face in using HCP data for outreach?

The biggest challenges include dealing with outdated or incomplete data, struggling to personalize outreach at scale, and knowing when to act on insights.

What tools can help sales teams automate and personalize their outreach?

AI-driven sales platforms help teams prioritize leads, tailor messaging, and optimize outreach timing.

How can sales teams measure the success of their data-driven outreach?

Key indicators include response rates, prescribing changes, and time to conversion.

Conclusion

Healthcare sales has always been about relationships, but relationships today are built differently.

The future belongs to sales teams who stop relying on assumptions and start acting on intelligence. The teams that figure this out will build stronger relationships, shorten sales cycles, and close more deals. The ones that don’t will probably keep wondering why providers aren’t responding.

Alpha Sophia provides detailed profiles of HCPs, including their taxonomy, state licenses, open payments information, and research contributions. This comprehensive data allows for a thorough analysis and understanding of HCPs, facilitating informed decision-making for partnerships and targeted campaigns.

Use Alpha Sophia to find medical practices