The Evolution of Software as a Medical Device (SaMD): Key Trends & Market Opportunities

A decade ago, if you told someone that software could diagnose diseases, monitor your heart, or predict a stroke before it happened, they’d call you crazy.

Medical devices were machines, implants, and tools. Now some of the most powerful medical innovations come in an app.

This is Software as a Medical Device (SaMD) that, on its own, performs medical functions. It helps you with faster diagnoses, better patient outcomes, and better healthcare.

And the market is exploding. But that growth comes with serious challenges. Regulations are tight, cybersecurity risks are real, and doctors don’t trust software because it looks impressive on a pitch deck.

So, where are the biggest opportunities? And how do you plan the regulatory maze without burning through years of time and thousands of dollars?

Let’s break it down.

What is SaMD and Why Does It Matter?

A few years ago, if you needed a medical diagnosis, you’d probably visit a doctor, get some tests done, and wait for results. Today, there are apps that can analyze your heart rhythm, software that can scan your lungs for cancer, and AI tools that can predict if you’re at risk for a stroke.

None of these require a physical device. That’s what SaMD is all about.

Regulators define SaMD as software that performs a medical function on its own—without being tied to specific hardware. That means it can diagnose, monitor, or even recommend treatments without needing a physical machine to operate.

The reason SaMD is a huge innovation in the medtech industry is:

- It enables faster and more accessible diagnostics

- AI and machine learning are improving accuracy

- SaMD can analyze individual patient data to deliver personalized treatment recommendations.

Key Trends Shaping the SaMD Market

SaMD today is about whether companies can actually get their products into the hands of doctors and patients. So, what’s really shaping SaMD’s market?

1. AI-based SaMD Is Constantly Learning And Evolving

AI-driven SaMD is already better than humans at certain tasks. It can flag early-stage cancers, predict cardiac issues before they happen, and even suggest personalized treatments based on a patient’s genetics.

But the problem is AI learns and adapts over time. That is something medical regulators have never had to deal with before.

That’s a massive regulatory headache. If an AI-based SaMD updates itself after approval, does it need to go through the entire certification process again?

And that’s slowing down approvals, even for products that work.

2. Cloud-Based SaMD is Convenient but Also a Security Risk

Hospitals used to run medical software on locked-down, in-house servers. Today, most SaMD tools are cloud-based and accessible from anywhere. That is great for patient monitoring, AI diagnostics, and data sharing between hospitals.

But it’s also a cybersecurity nightmare.

In the last three years, ransomware attacks on hospitals have skyrocketed. The FDA now requires cybersecurity proof before a SaMD product can even be considered for approval.

Europe’s MDR has similar demands. So, if your software isn’t built with security in mind, it won’t get approved.

3. Regulatory Bottlenecks Are Getting Worse

In the U.S., the FDA is trying to streamline approvals with a new Digital Health Pre-Cert Program, but it’s still in pilot mode.

In Europe, the MDR has made approvals so strict that many SaMD companies are skipping the European market altogether.

That means companies have to make a choice:

Japan, Australia, and Canada have more predictable approval pathways, and some companies are launching there first. So, the bottom line is you’re wasting time if you’re not thinking about regulatory hurdles from day one.

4. Big Tech is Squeezing Out Startups

Apple’s ECG feature in the Apple Watch is FDA-approved. Google’s AI models are being integrated into hospital workflows. Microsoft is embedding AI diagnostics into healthcare records.

So what’s left for smaller players?

Niche markets. Big Tech wants mass-market solutions. Startups that focus on rare diseases, ultra-specialized diagnostics, or underserved populations still have a shot.

Market Opportunities & Growth Potential in SaMD

Healthcare is slow, expensive, and reactive. SaMD is growing because it offers speed, scalability, and efficiency where traditional models fail.

So, the biggest opportunity is to make software that actually fits into clinical workflows. AI diagnostics, remote patient monitoring, and digital therapeutics are booming, but success depends on how well they integrate.

AI-driven diagnostics

Hospitals are already using AI to detect cancers, heart conditions, and retinal diseases earlier and with more accuracy. The opportunity is to expand AI beyond radiology and into pathology, cardiology, and primary care.

Remote patient monitoring

The real potential is in software that connects remote care devices to physicians in a meaningful way.

Digital therapeutics (DTx)

FDA approvals for software-based treatments are growing, especially in mental health, addiction, and chronic pain management. Investors are shifting from “health apps” to clinically validated digital treatments.

So, the companies that succeed in SaMD will be the ones that understand how to get through approvals, integrate into existing healthcare systems, and prove clinical outcomes.

Regulatory Landscape & Compliance Considerations

Regulation is the biggest make-or-break factor for SaMD.

Medical device regulations were built for hardware. Once approved, a device stays the same. SaMD, especially AI-driven models, changes over time. Regulators don’t know how to handle that.

So, the biggest hurdles will be:

- Securing approvals for AI-driven models that evolve.

- Global inconsistencies in rules.

- Post-market monitoring.

Therefore, delaying compliance is one of the costliest mistakes you can make. Those who master it early get to market faster and dominate.

Commercialization Strategies for SaMD Companies

Many companies fail because they treat commercialization as a secondary step. In reality, regulatory strategy, reimbursement methods, and provider adoption need to be planned from the very beginning.

Use Regulatory Approval as a Competitive Advantage

The U.S. remains the fastest path for most SaMD companies, as the FDA has clearer digital health pathways than the EU’s MDR.

So, start in the U.S. to get some regulatory traction, then expand to Europe or Asia once approvals are secured. Some companies are even targeting Japan or Australia first, where regulatory pathways for SaMD are more structured.

Reimbursement Is The Biggest Barrier to Adoption

If insurers and healthcare systems won’t pay for it, doctors won’t use it. Get CPT codes or payer coverage because it is just as critical as FDA approval.

Integration into Existing Healthcare Systems

If your SaMD product doesn’t integrate with EHRs like Epic or Cerner, it won’t get used.

Try to build interoperability from the ground up. Some companies license API-based integrations or partner with EHR vendors to fast-track implementation.

B2B Models Scale Faster Than Direct-to-Consumer (DTC)

Selling directly to consumers is tough because most won’t pay out-of-pocket for medical software. Always target health systems, insurers, and pharma companies rather than individual patients.

The Future of SaMD: What’s Next?

The next phase of SaMD is going to see whether regulators and healthcare systems can actually keep up with AI and the technology available today.

Either regulators will have to adapt, or companies will be forced to work around them. Until then, many AI-driven SaMD products will be stuck in a cycle where every update triggers a new approval process, delaying adoption.

The other shift will be in how SaMD integrates with real-world clinical systems. Right now, most AI-driven SaMD exists as a separate tool that hospitals have to figure out how to use. That’s not sustainable.

The next wave will be built directly into existing medical infrastructure. That will fundamentally change how these products are regulated and reimbursed.

FAQs

How is SaMD different from traditional medical devices?

Traditional medical devices are hardware-based (e.g., pacemakers, MRI machines). SaMD is pure software that performs medical functions without relying on dedicated hardware.

What industries benefit the most from SaMD?

Healthcare providers, diagnostics, digital therapeutics, remote patient monitoring, and personalized medicine all see major advantages from SaMD adoption.

How does AI impact the future of SaMD?

AI enables faster, more accurate diagnostics and predictive analytics, but it also complicates regulation since AI models evolve over time, requiring new approval frameworks.

How can SaMD companies accelerate market adoption?

By ensuring regulatory compliance early, integrating with existing clinical workflows, and securing reimbursement approval. No doctor or hospital will adopt software that disrupts their system or isn’t covered by insurance.

What future trends will shape the SaMD market?

SaMD will move away from standalone applications and become embedded into medical devices and real-time hospital systems. Regulators will need to adopt adaptive approval models to keep pace with AI-driven software, and companies will increasingly look to markets like Japan and Australia, where approval pathways are clearer, and adoption is growing faster than in the U.S. or Europe.

Conclusion

SaMD is moving fast, but the real challenge is getting it to work within the realities of healthcare. AI can diagnose diseases, predict risks, and even recommend treatments, but if hospitals can’t integrate it into their existing systems or if insurers won’t cover it, it’s just another great idea that won’t scale.

That shift will change how these products are regulated, approved, and paid for. So, you’ll be a frontrunner if you figure out how to make it usable, scalable, and indispensable to healthcare.

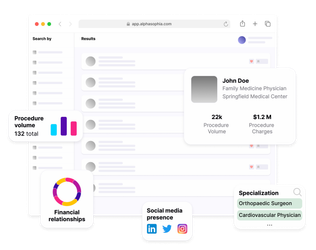

Use Alpha Sophia to identify healthcare providers