What Is Market Access In Healthcare? Its Role In Drug Pricing & Reimbursement Strategy

Bringing a new drug to market is not just about getting FDA or EMA approval.

You can develop a revolutionary cancer treatment, secure FDA approval, and even publish outstanding clinical trial results, but if insurers refuse to cover it or governments say it’s too expensive, patients won’t get it.

Market access is what determines whether a drug or medical device actually reaches patients. For example, if a new cancer drug costs $150,000 a year and an insurance company decides it’s too expensive, patients either pay out of pocket (which is rare), fight through appeal processes, or simply go without.

The same goes for medical devices. If a hospital can’t justify the cost of a new robotic surgery system, it won’t invest in it, no matter how advanced it is.

And market access is only getting tougher.

In this article, we’ll discuss why market access is one of the most critical and complex aspects of modern healthcare and how companies succeed (or fail) in bringing new treatments to patients.

What is Market Access in Healthcare?

Getting a drug approved is one thing. Getting it to patients is another.

Market access is the process of making sure a drug or medical device is reimbursed and actually used in real-world healthcare. It’s proving to insurers, governments, and healthcare providers that a treatment is worth paying for.

For example, regulatory agencies like the FDA or EMA might approve a new drug, but if insurers decide it’s too expensive or no better than existing treatments, they may refuse to cover it. Without coverage, most patients won’t be able to afford it, and doctors will hesitate to prescribe it.

This is why pharmaceutical companies must think about market access long before a product even reaches the market.

How Market Access Affects Drug Pricing

When a company brings a new drug to market, it must convince insurers and government payers that the price is justified. If payers don’t see enough value, they push back, demanding discounts, limiting coverage, or outright refusing reimbursement.

Take Europe’s health technology assessments (HTAs) as an example. Before a drug gets reimbursed, agencies like NICE (UK) or IQWiG (Germany) assess whether it provides better outcomes than existing treatments.

Pharmaceutical companies use different pricing strategies to negotiate these barriers:

- Value-based pricing

- Tiered pricing

- Risk-sharing agreements

Without a strong market access plan, even the most promising drugs can face restricted pricing, delayed launches, or exclusion from coverage lists.

The Role of Market Access in Reimbursement Strategy

Reimbursement is the single biggest factor determining whether patients will have access to a new drug. If a treatment is not reimbursed, very few people will be able to afford it, no matter how effective it is.

So, pharmaceutical companies must negotiate with insurers, government health programs, and hospital systems to secure reimbursement.

Here’s how reimbursement decisions are generally made:

- Health technology assessments (HTAs) – In countries like the UK and Germany, HTA agencies evaluate whether a drug provides enough benefit for its price. If it doesn’t, reimbursement is denied, or price reductions are required.

- Cost-effectiveness models – Insurers analyze whether a drug improves health outcomes at a cost that justifies coverage. Treatments that reduce hospitalizations or long-term complications often have a better chance of approval.

- Budget impact analysis – Payers assess how much covering the drug will cost on a national or insurance-plan level. Expensive treatments with broad patient populations often face more restrictions.

To improve reimbursement success, companies often:

- Engage with payers early to understand their requirements.

- Offer innovative pricing models, such as pay-for-performance contracts where payment depends on how well the drug works.

- Provide real-world evidence (RWE) to support long-term value beyond clinical trials.

Without reimbursement, even a groundbreaking drug will struggle to reach patients. That’s why you need to build reimbursement strategies into their market access planning from the earliest stages of development.

Regulatory and Compliance Challenges in Market Access

Unlike clinical approval, which focuses on safety and efficacy, market access regulations are about pricing, reimbursement, and real-world impact. Governments, insurers, and health authorities impose strict requirements before agreeing to cover a treatment.

Here’s where companies run into trouble:

1. Post-Approval Price Regulations

In Europe, Canada, and Japan, governments regulate prices after a drug is approved. Companies often don’t have full control over what they can charge.

For companies, this means a drug may get approved but still be stuck in limbo while price negotiations drag on for months or even years.

2. Reimbursement Delays and Bureaucracy

Even when a drug is clinically approved, it can take 12-24 months to secure reimbursement in some countries. This is why patients in some countries get access to new drugs faster than others.

3. Real-World Evidence (RWE) Demands

Regulators and payers want real-world evidence showing how a drug performs outside controlled trials. If post-market data doesn’t confirm the expected benefits, payers may cut reimbursement, restrict access, or demand price reductions.

This is especially true for expensive specialty drugs and gene therapies.

4. Anti-Competition Laws and Parallel Trade

In the EU, pharma companies can’t set different prices in each country without running into parallel trade issues (where lower-priced drugs are imported into high-cost markets).

These regulatory hurdles mean companies must think beyond approval and plan for long-term compliance, pricing shifts, and policy changes in each market.

Market Access Strategies for Pharma & MedTech Companies

To overcome the challenges we mentioned above, pharmaceutical and medtech companies use different strategies:

1. Engaging Payers Early

Waiting until after regulatory approval to discuss pricing and reimbursement is a mistake. Insurers and government payers want cost-effectiveness data early.

So, you should consult with HTA agencies during development to align on expectations, reducing delays in reimbursement approvals.

2. Value-Based Pricing & Risk-Sharing

Payers are moving away from fixed pricing. Instead, companies must offer outcomes-based contracts, where they only get paid if the drug works.

3. Market-Specific Pricing Strategies

Pricing a drug too low in one country can trigger forced price cuts elsewhere due to International Reference Pricing (IRP). So, plan launch sequences and pricing tiers across markets to avoid revenue loss.

4. Real-World Evidence (RWE) for Reimbursement

You should invest in post-market studies and patient registries to maintain reimbursement and negotiate better coverage terms.

5. Local Market Adaptation

Companies must draft strategies for local regulations, payer expectations, and provider prescribing habits to ensure widespread adoption.

Global Trends & the Future of Market Access

One of the biggest shifts is happening in the U.S., where Medicare now has the power to negotiate drug prices. This is a major departure from the traditional free-pricing model, and it will likely lead to lower prices for some high-cost therapies.

At the same time, value-based pricing is becoming the norm. Instead of paying a fixed price for a drug, insurers and governments are demanding performance-based contracts. If a drug doesn’t work as expected, the manufacturer must refund part of the cost or adjust pricing.

Real-world evidence (RWE) is also playing a larger role. Payers now expect post-market data proving that a treatment delivers sustained benefits in real-world patients. So, companies are investing in long-term patient registries and AI-driven analytics to generate the evidence required to maintain reimbursement.

Looking ahead, companies that want to stay competitive in market access will need to engage payers early, prove real-world value, and adapt to evolving pricing and reimbursement policies.

FAQs

Why is market access important?

Because without it, a drug is just an idea that never reaches patients. Regulatory approval means nothing if insurers or governments refuse to cover a treatment.

What factors influence drug pricing in market access?

If a drug extends life, prevents complications, or reduces hospital stays, it has a stronger case for a higher price. But if payers see it as just another version of what’s already available, they’ll push back on price or restrict reimbursement.

What role do payers (insurance companies & governments) play in market access?

Payers decide who gets what. They determine who qualifies for coverage, how much is reimbursed, and whether a treatment is worth its price. If a drug fails to meet its cost-effectiveness standards, access can be limited, delayed, or denied entirely.

How does AI and big data impact market access?

AI is helping companies predict pricing trends, model reimbursement scenarios, and analyze real-world data to strengthen their case with payers. In a world where payers demand proof beyond clinical trials, big data is becoming the key to long-term access.

What are the future trends in market access?

Governments and insurers are pushing for value-based pricing, real-world evidence requirements, and stricter cost controls. The companies that win in market access will be the ones that can prove, over and over again, that their drugs are worth paying for.

Conclusion

Market access is the final barrier between drug approval and patient use.

For too long, pharmaceutical companies have treated market access as an obstacle to overcome instead of a core part of drug development. That mindset no longer works.

Today, pricing, reimbursement, and payer engagement must be built into the process from the very start because a drug without access is a drug without impact.

Companies that recognize this and invest in long-term value demonstration, flexible pricing models, and real-world performance tracking will be the ones that will lead the pack in the coming decade.

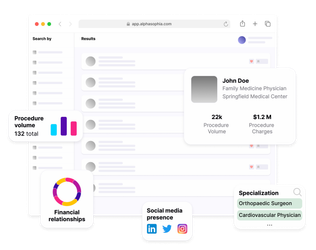

Use Alpha Sophia to identify healthcare providers